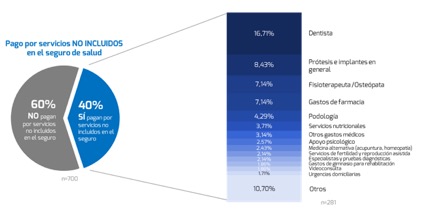

Health insurance policyholders who pay health expenses out of pocket account for 40%. Their main expenses are: dentists, prosthetics and implants in general, physical therapy, and osteopathy.

Among the specialties covered by insurance, the five most in demand are: general medicine, dermatology, traumatology, gynecology/obstetrics, and ophthalmology.

BRAINTRUST, in its Second Insurance Sector Competition Observatory: Health Branch, when analyzing the profile of health insurance policyholders, reveals that 40% of them pay for certain services not included in the insurance, mainly those related to dentistry (16.71%), prostheses and general implants (8.43%), and physical therapy and osteopathy (7.14%).

The study also shows that the most commonly used health insurance specialties, based on frequency and number of times used per year, are general medicine, followed by dermatology, traumatology, obstetrics and gynecology, and ophthalmology in fifth place, while at the opposite end of the spectrum are cardiology, psychology/psychiatry, pulmonology, and oncology.

The study also shows that the most commonly used health insurance specialties, based on frequency and number of times used per year, are general medicine, followed by dermatology, traumatology, obstetrics and gynecology, and ophthalmology in fifth place, while at the opposite end of the spectrum are cardiology, psychology/psychiatry, pulmonology, and oncology.

This order does not entirely coincide with the ranking of the number of times each specialty is used per year. General medicine continues to rank first (2.51 uses per year), but from second place onwards the ranking changes, with hematology/analytics coming next (1.47 uses per year) and rehabilitation/physical therapy in third place (1.29 uses per year). The least frequently used specialties are urology, endocrinology, and podiatry.

The consulting firm has also delved deeper into understanding the expectations of health insurance users. When asked about services not currently included that they would like their health insurance company to offer, policyholders' responses were very clear: the most desired services are assistance for the elderly, genetic testing and profiling, and sports medical checkups.

BRAINTRUST also asked users where they would place their trust if companies not specializing in health insurance were to market this product. According to their responses, 20.5% would choose technology companies and 18.74% would choose electricity and/or gas companies. They place less trust in telecommunications operators, department stores, e-commerce companies, transport companies, and social media.

According to the analysis carried out by BRAINTRUST in its Observatory of Competition in the Insurance Sector: Health Branch, a clear picture of the strengths and weaknesses of private healthcare is revealed. In terms of strengths, private healthcare has many values and virtues, notably its contribution to the sustainability of the healthcare system, quality, flexibility, professionalism, and the efficiency of professionals and specialists. The patient-customer is the best and most critical judge, and this is evident when deciding to take out health insurance. At the same time, the responses of the insured themselves reveal certain weaknesses that could be improved, such as expanding and offering new services, promoting dental coverage, physical therapy, or prosthetics in private insurance to try to increase their value. This would largely eliminate expenses for services not included in health insurance.