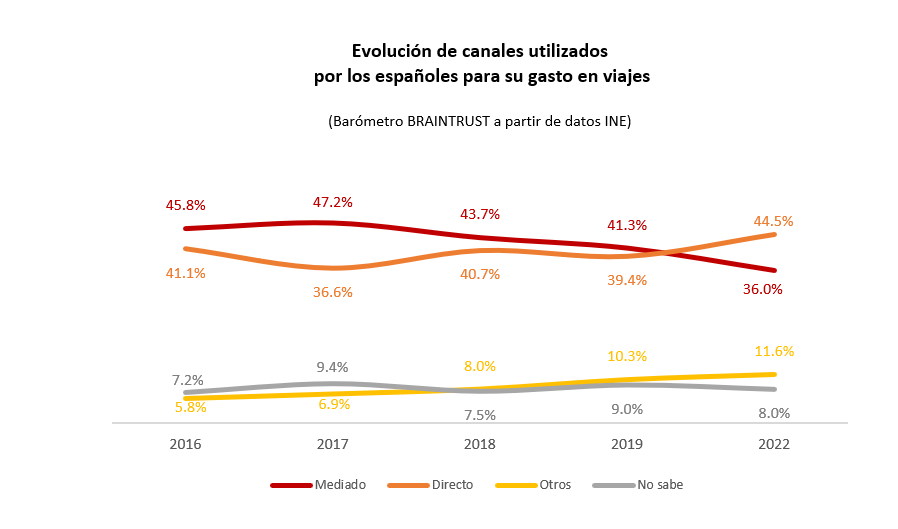

BRAINTRUST, a leading consulting and professional services firm in the tourism sector, has released a new industry analysis, in this case on the purchasing behavior of Spanish travelers, based on who they buy their trips from and how, with the direct channel exceeding 44% of the market share compared to 36% for the mediated channel, leaving 11% for other channels (specialized platforms), and 9% for travelers who did not respond.

Thus, BRAINTRUST states that, although there are rumors that the mediated channel will disappear, it continues to resist the push for direct sales by end suppliers.

In fact, the consulting firm highlights that the battle between direct sales and mediated sales continues, and that given the complexity of traveling today, new players continue to emerge in distribution, promoting the concept of intermediation of intermediation.

Direct sales overtake mediated channels

BRAINTRUST takes an in-depth look at Spaniards' travel spending, analyzing the changes in consumer behavior and comparing the data with 2019, the year before the pandemic.The direct channel now accounts for 44% of spending, ahead of the mediated channel, which stands at 36%, although it is true that the gradual internationalization of travel after the pandemic may help intermediaries to hold their ground and even gain some market share in the coming months.

Comparing the data from 2019, the direct channel was close to 40%, while the mediated channel accounted for 41%, with both fighting fiercely to lead the Spanish market.

For Angel Garcia Butragueño, Co-Director of the Tourism Barometer, and Director of Tourism at BRAINTRUST: "Intermediation continues to resist the push for direct sales, where all suppliers are creating disintermediation strategies to dominate customer relationships and improve their bottom lines. It is true that, although the pandemic has led to a rearmament of agencies in their role as advisors, on the other hand, it has led to an increase in the use of technology that has helped travelers to be able to put together some trips on their own without the help of experts, especially less complex trips. In the future, we will see the disappearance of agency sales outlets, which will tend to specialize in making their spaces places of inspiration and enjoyment, where the activity is not so much to inform but to inspire and recreate travelers' experiences using technology at the service of people. Our estimates indicate that by 2030, the number of sales outlets in Spain will fall from the current 9,500 to 6,000, thus reducing the agency network, although their turnover will be infinitely greater, and therefore productivity and efficiency will be significantly higher. Personally, I think that agencies will continue to have their differential value as long as they evolve, provide their customers with a unique and differentiated experience through different channels, offering personalized alternatives for each customer and not mass-produced packages, which may have their days numbered..”

Senior travelers are also signing up for direct booking

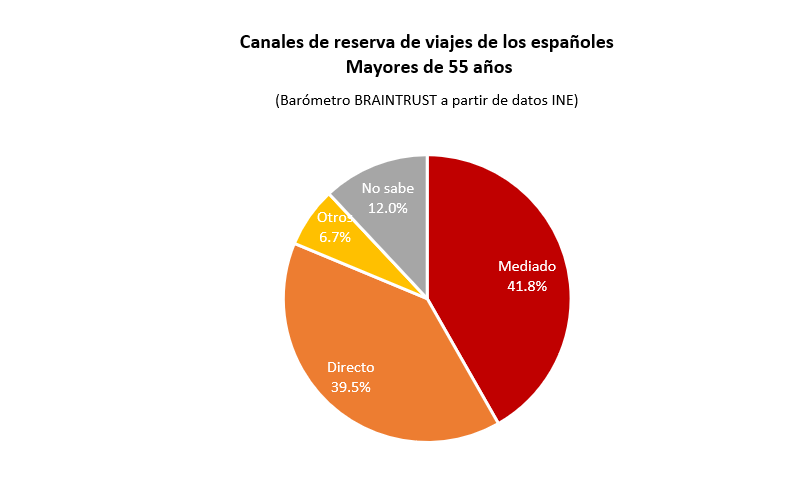

Senior travelers—traditional customers of brick-and-mortar travel agencies—who today account for 27% of total travel spending in the Spanish market, are also jumping on the direct booking bandwagon, thanks to the technological advances that consumers have experienced during the COVID-19 pandemic, where we have all become accustomed to using the technologies available to us.

Current data shows that this generation over the age of 55 is also in favor of booking directly, accounting for up to 39.5% of their total travel expenditure, compared to 41.8% through the mediated channel. They remain loyal to expert travel advisors, especially for organized itineraries, a format with which they feel more comfortable, preferring to seek advice from travel agents who know their job and provide added value that sets them apart from the "do it yourself" approach.

Agencies continue to dominate package tour sales

Delving deeper into the analysis, BRAINTRUST observes in detail how the sale of package tours continues to be dominated by traditional travel agencies, a space they masterfully control, and which remains the predominant distribution channel for tour operators, who continue to market their programs primarily through physical agencies for the time being.

With 97% of packages sold in agencies and 31% sold digitally, 69% are still booked with a travel agent in person, by phone, by email, and lately by WhatsApp, but always with traditional agency brands.

The hotel and transportation industries: areas of direct sales

In the hotel industry, direct bookings already account for 56% of the total, while intermediaries account for 44% of total hotel spending by Spanish travelers, demonstrating that although hotels continue to prefer and pursue direct relationships with customers, both generalist and specialized intermediaries remain a favorite channel for consumers to date, building upselling and cross-selling strategies to increase their share of this product.

In the transport sector, suppliers take the lion's share of the market, dominating this field and ensuring that Spanish travelers book directly for 74% of total expenditure. This shows that this is a commodity product where price takes precedence over similar offers from most suppliers, and where advice is meaningless for many users.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST:"The analysis of the data in our possession, which we follow with great interest to help our clients with their commercial strategies, shows which products are commodities that travelers can book on their own, while other products are more complex and require expert advice. It is important to continuously monitor these analyses because reality changes from one day to the next, consumers change their purchasing habits, and technology advances, so strategies that are valid today may not be valid tomorrow. We always advise our clients, tourism companies, to look not only at the short term, but also at the medium and long term, because nothing will ever be the same again, and travel distribution must evolve its sales, reaching full omnichannel capability, or it will be dead forever.