BRAINTRUST, a leading consulting and professional services firm in the tourism sector, has released a new industry analysis, this time on Spanish travel spending, thanks to a new wave of its Tourism Barometer. In it, it states that it is important to look closely at the data on travel purchases by tourism companies, as the evolution of the traveler continues and it is necessary to be very attentive in order to make the right decisions.

Madrid, Catalonia, and Andalusia alone account for more than half of Spaniards' travel spending.

BRAINTRUST takes an in-depth look at Spaniards' travel spending, seeking to identify opportunities for tourism companies, always from the point of view of the issuer, and to provide interesting data that allows players in the value chain to tailor their offerings to the habits of each autonomous community. Five autonomous communities account for a large share of the pie, with Madrid topping the ranking with 20.7% of total spending in Spain, followed by Catalonia with 18.6%, Andalusia with 13.7%, the Valencian Community with 8.2%, and the Basque Country with 5.9%, with these five regions accounting for two-thirds of the market. All this data is further proof that analyzing data is critical for all entrepreneurs in the tourism sector.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST: "We have been suggesting for some time that the market and tourism companies analyze travel consumption data and translate it into business decisions, including it in future strategies. We cannot continue to build an industry based on intuition in the era of big data. Travel expenditure data by region should help companies in this industry to scale their organizations and points of sale, as well as to adapt their sales, communication, and marketing strategies. We continue to see mass strategies that invest money without taking into account the location and characteristics of their target audience, which is a waste of resources and efforts that lead to a loss of competitiveness as a country and as a sector."

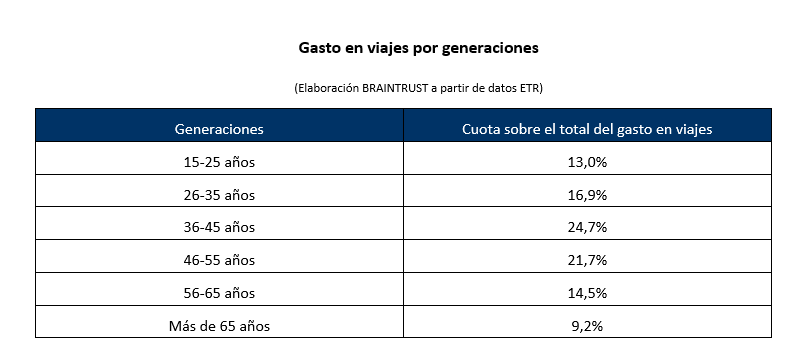

Millennials and Gen Zers now outspend previous generations on travel, pointing to a new product and new channels.

Analyzing the data separately, BRAINTRUST highlights the clear difference between generations, with younger generations already accounting for the largest share of total spending at 54.6%, while older generations are gradually reducing their share as they age, and today account for only 45.4%. For BRAINTRUST, brick-and-mortar travel agencies attract older generations, but if their share is declining, they need to consider how to attract younger generations if they want to survive.

Singles spend a total of around €13 billion, 39.4% of total spending.

BRAINTRUST continues its analysis of the sector, with the aim of helping the tourism industry to recover and transform itself. The consulting firm states that when it comes to purchasing travel, single people represent a huge niche opportunity for the entire industry, as their spending amounts to €12.829 billion, accounting for 39.4% of the total, while married people have a total expenditure of €16.599 billion, accounting for 51%, widowed people account for 2.7%, separated people for 1%, and divorced people for 5.9%. These data offer a glimpse of the opportunities, not only to tailor the offer but also to establish an optimal narrative, depending on the travel objectives of each group.

Households with lower incomes spend one-fifth of the total market

Continuing with its research, BRAINTRUST analyzes travel spending by household type based on annual income, drawing very interesting conclusions for the development of tourism providers' offerings.

Getting down to business, the consulting firm states that 18.9% of total spending is accounted for by households with less than €1,500 in monthly income, even though they represent 31.7% of the population, while at the other end of the scale are households with more than €3,500 per month, which, despite accounting for less than 15% of households, account for 29.7% of spending. In between are households with incomes between €1,500 and €3,500, which represent 51.4%.

According to Angel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST: "The opportunities in the travel market are becoming increasingly clear, and there is an optimistic outlook for medium- and long-term growth. There are many obvious gaps that companies are missing out on by not observing the behavior of Spanish travelers. New markets are being created, new customers are appearing, new niches are emerging, new travelers are sprouting up, new products and channels are flourishing, and all of this represents an unmissable business opportunity for companies in the sector. The market will never be the same again in terms of travel consumption habits. We must prepare the product, the channels, the communication, and the marketing; in short, we must offer each traveler what they need at every moment of their travel journey according to their travel objectives. At BRAINTRUST, we continue to help the tourism industry visualize an optimistic future, but one that is very different from what we are used to. Only those who are attentive and adjust their offerings to the new circumstances will be able to take advantage of the manna of a new, more innovative, resilient, profitable, and sustainable tourism industry.