BRAINTRUST, a leading consulting and professional services firm in the tourism sector, has released a new industry analysis, this time on Spaniards' spending forecasts for this summer, in which it notes that the euphoria is moderating, although the outbound market will continue to grow by around 5%, provided that the early elections do not drastically change Spaniards' travel plans.

BRAINTRUST notes that the slowdown is beginning to appear, following the euphoria unleashed at the end of 2022 and beginning of 2023, when growth was very high, even exceeding pre-pandemic levels, caused in part by an expansive personal attitude among individuals in a post-pandemic era, and to a large extent also by high prices, the result of runaway inflation in recent months.

The source market continues to grow, albeit at a slower pace, with an expected increase of less than 5%.

BRAINTRUST takes an in-depth look at Spaniards' travel spending, analyzing the changes in consumer behavior since the end of the COVID-19 crisis.

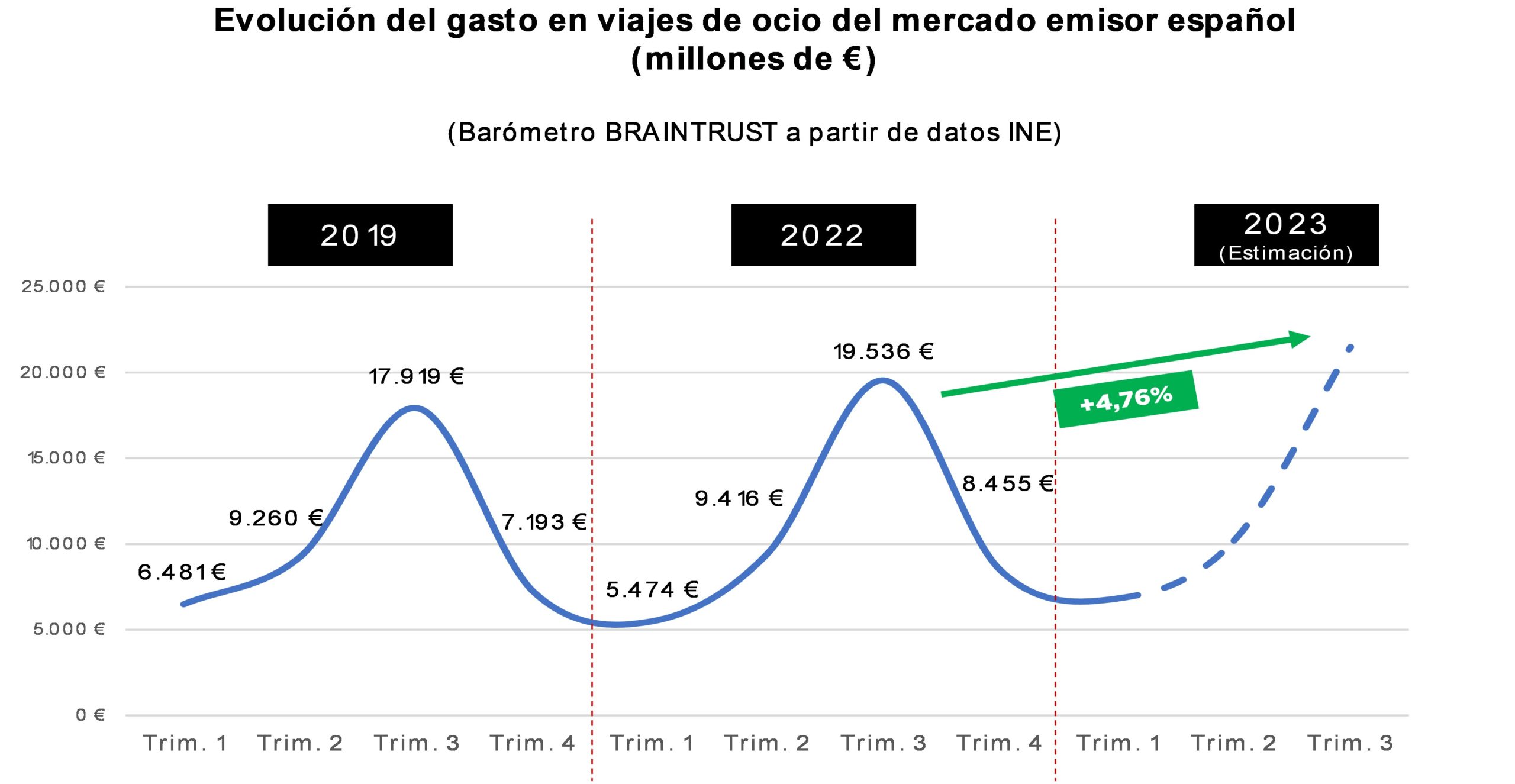

After analyzing the data, the consulting firm concludes that while in 2019 total spending was €40.853 billion and summer accounted for 43.86% of total annual spending by domestic travelers, in 2022, total spending was €42.881 billion, with summer accounting for 45.56% of the annual total.

In this regard, 2023 will see growth of 4.76% next summer, which includes the months of June, July, August, and September, confirming the moderation in spending, provided that the early elections do not change Spaniards' travel plans. This caution comes as savings have been depleted by high prices for various household consumption items, a consequence of excessive inflation in recent months, encouraging households to engage in financial engineering to meet their various needs, and where travel, even though it is a clear priority ahead of other expenses such as technology or well-being, requires greater planning and budget restraint.

According to Ángel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST: "These figures show a clear slowdown in spending by Spanish travelers, which, far from causing the downturn we all feared, demonstrates the resilience of the tourism sector and brings us back to the reality of the macroeconomic data. Our analysis once again provides the right context for tourism companies to make the right decisions after the volatility of the figures in recent years, going from high activity to a debacle during the pandemic, and to disproportionate euphoria in recent months. This stage marks the beginning of a new era in which the transformation of the sector will once again be the priority, and in which digitalization, sustainability, and talent will set the industry's agenda for the next decade.

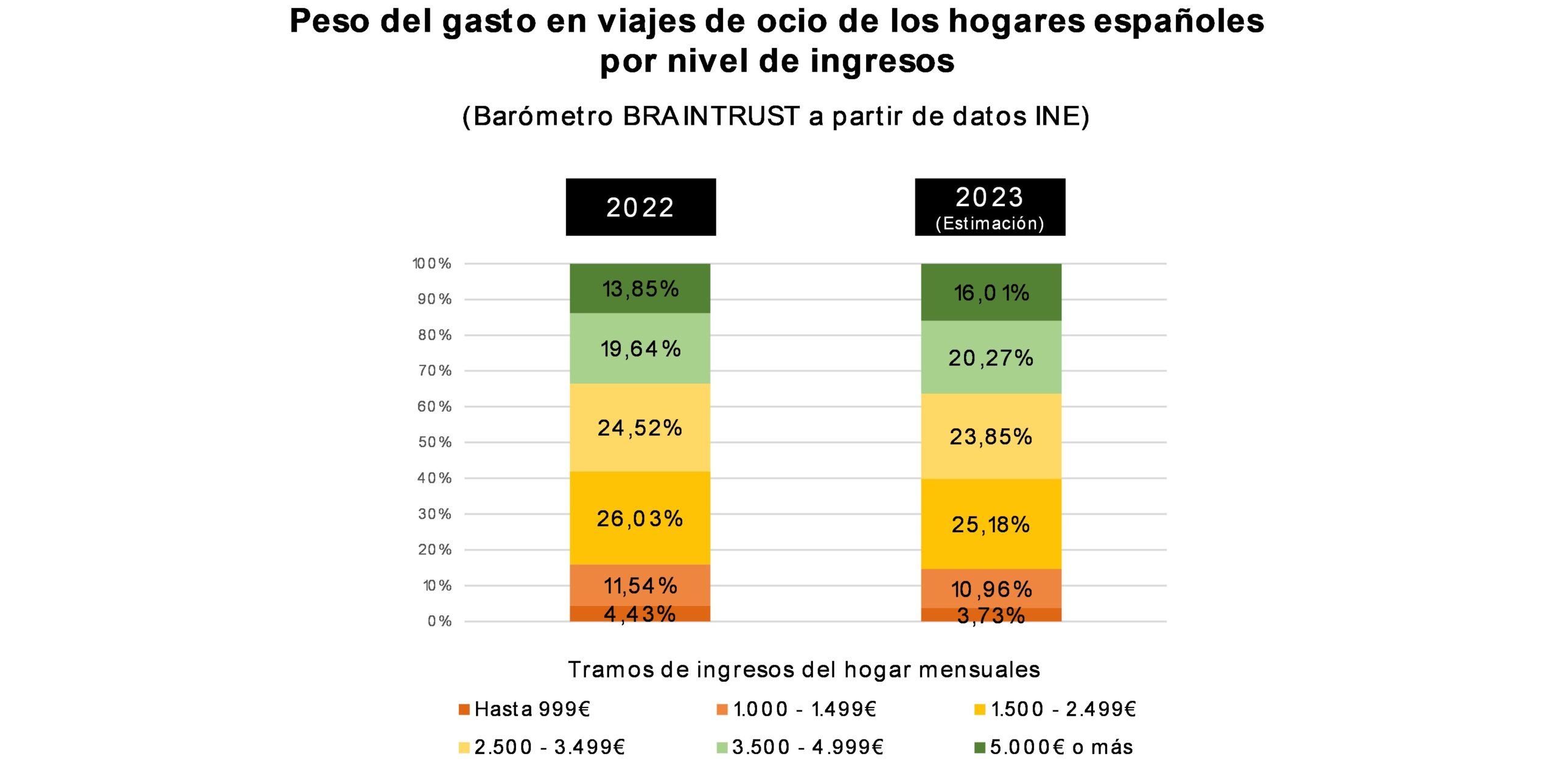

Domestic destinations are once again dominating, especially among households with lower purchasing power.

BRAINTRUST takes a closer look at travel spending by household income, highlighting the importance of spending in the outbound market for different social classes. The lower-income social class will be the most disadvantaged, as it will be heavily affected by inflation, as was to be expected. In this context, domestic destinations will once again be the most popular, especially among travelers with lower incomes, who will adjust their travel budgets by either reducing their spending or shortening the length of their stay.

While in 2019 domestic spending accounted for 66.60% of total spending in the outbound market, in 2020 and 2021 it was 83.08% and 83.36% respectively, and fell again to 70.45% in 2022 with the end of the pandemic. it is expected to return to 2019 levels this summer of 2023, but bearing in mind that last year the omicron wave limited long-distance international travel.

Faraway destinations are becoming more popular among high-income travelers seeking unique experiences.

In a post-pandemic era, and as a lesson learned from the experience, travelers need to regain their freedom and enjoy unique, once-in-a-lifetime experiences. This translates into so-called experiential travel, which is on the rise compared to previous years and is mainly the domain of travelers with high or very high purchasing power.

These experiential trips are mainly marketed in brick-and-mortar agencies and focus on providing personalized and exclusive itineraries that go beyond the standard trips traditionally chosen from a brochure.

In fact, this type of travel is expected to remain popular in the future, with growth of 56.11% expected this year compared to 2022, where, following the omicron wave, sales were sluggish due to health and/or geopolitical uncertainty after the start of the conflict in Ukraine.

Some examples of this type of travel are expedition cruises, safaris, wellness retreats, extreme adventures such as sleeping in cabins attached to cliffs overlooking precipices, or space travel, which is becoming increasingly popular among wealthy travelers.

The all-inclusive craze is back, highlighting the need to curb spending by Spanish travelers

As was to be expected, and as rumors had suggested, Spaniards' savings capacity has declined considerably in the wake of the pandemic. This, combined with high inflation and the resulting difficulty in meeting recurring household expenses, calls for prudence and austerity, even when it comes to vacations.

BRAINTRUST states that all-inclusive trips, mainly marketed by agencies, whether physical or digital, are back in the spotlight due to their advantages in terms of moderating spending, with a predicted increase of more than 33.46% this summer compared to the pre-pandemic period.

Travelers interviewed by BRAINTRUST Barometer point out the many advantages of these packages, such as a clear and secure budget, the comfort and convenience of not spending more than agreed upon at the destination, greater savings due to the elimination of unforeseen expenses, the peace of mind of being able to consume as much as you want for the same price, a variety of activity options, and having a travel agency that can resolve any issues that may arise at the destination.

According toJosé Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST: "At BRAINTRUST, we closely monitor the evolution of the industry with real data and accurate forecasts that should help companies in the sector to set their plans accordingly. It is clear that tourism will continue to be the driving force behind our economy, but new challenges are emerging that must be addressed by transforming the way we do things, based on the data. At BRAINTRUST, we put artificial intelligence at the service of business, at a time when looking to the future with information allows us to build more accurate strategies, free from intuition and/or past experience, as they say in the markets, past results do not guarantee future returns."