BRAINTRUST, a leading consulting and professional services firm in the tourism industry, has issued new travel forecasts for 2022 regarding foreign tourist spending in Spain, thanks to a new wave of its Tourism Barometer following the escalation of the conflict between Ukraine and Russia.

The impact of the conflict in Ukraine versus Omicron on foreign tourism spending

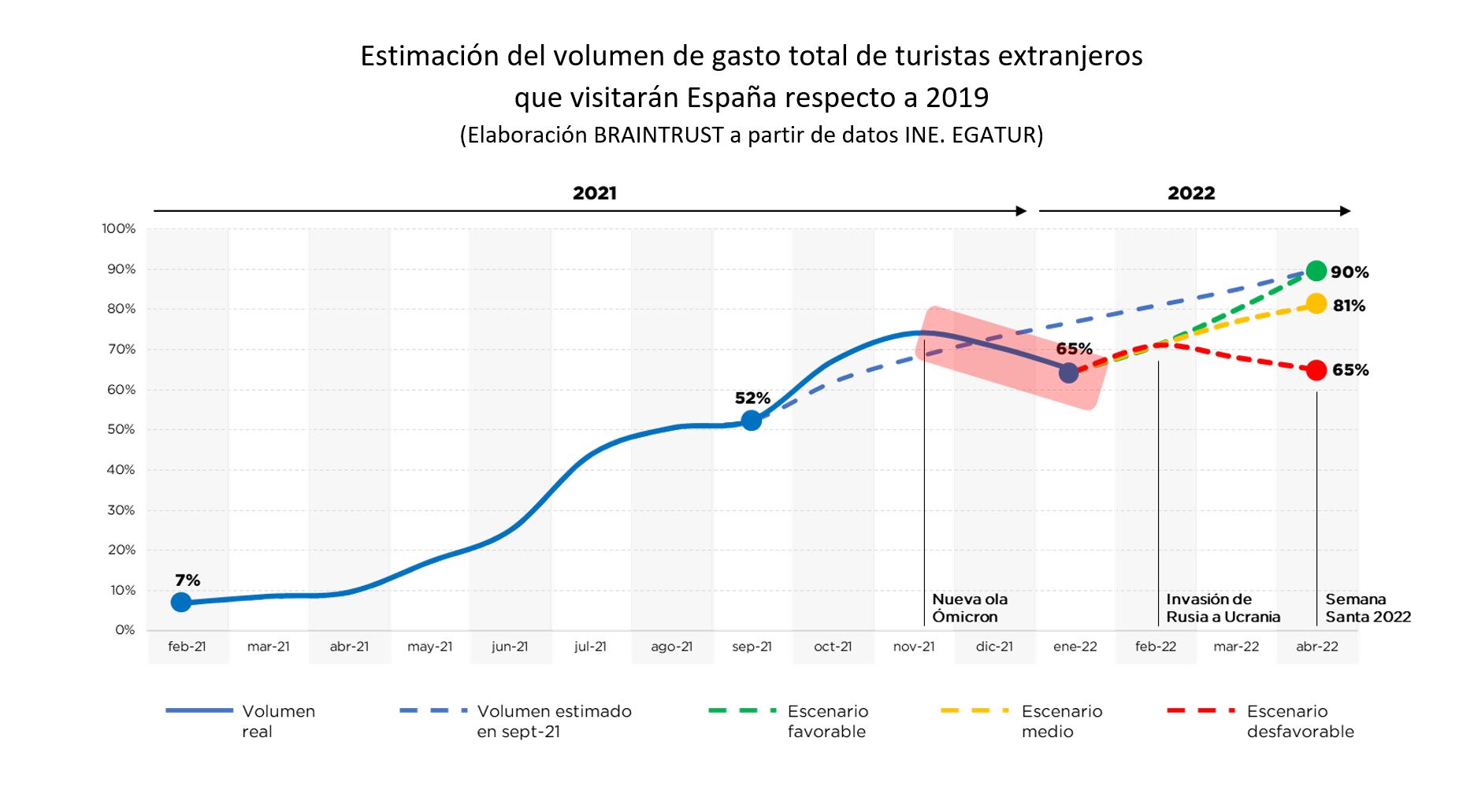

Analyzing the trend in total spending by foreign tourists during the first three quarters of 2021, at BRAINTRUST we were able to predict that the almost full recovery of inbound tourism would come during Holy Week 2022; In fact, during October and November, the actual data was better than estimated, but then Omicron came along and put a stop to everything, followed by Russia's invasion of Ukraine, forcing us to rethink what will happen during the upcoming Holy Week in Spain.

BRAINTRUST envisions three possible scenarios that could unfold in the coming weeks and months:

- In a favorable first scenario, where the cumulative incidence continues to decline in Spain and the rest of the world, and the current conflict between Russia and Ukraine ends, it is possible that during Holy Week 2022, the volume of foreign tourists visiting Spain will be practically the same as in the same month in 2019, with a recovery of around 90% of international spending.

- In a second, moderate scenario, where COVID may continue to give us a break, but the conflict shows no signs of ending quickly, tourism could be affected and recovery would be slower.

- In a third unfavorable scenario, possibly caused by the war becoming entrenched and the rebound in raw materials beginning to seriously affect domestic economies, international tourism, and more specifically European tourism (which accounts for between 85% and 90% of the number of foreigners), would fall to Omicron levels, and the decline could even be more pronounced.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST: "Black swans continue to affect tourism, and in this case, the conflict in Ukraine could have a greater impact than previous COVID variants. Brell states that expectations may change not only because of the war itself, but also because of its impact on the tourism industry, due to the sanctions imposed on Russia and their collateral effect on the increase in much of the usual household expenditure, which will mean less capacity for savings. The duration of the invasion will also have an impact, as is logical, which could lead to a stagflationary threat that will have a major impact on global growth, along with a fear of escalating war that will emotionally reduce the desire to travel, given the dangers that the current situation could cause. Finally, Brell highlights the importance of translating data into strategies in an increasingly uncertain context, where intuition is useless and only good analysis provides information for decision-making.

Domestic tourists will once again be key to the recovery of tourism

Given these figures, BRAINTRUST highlights in its latest Tourism Barometer survey that domestic tourists could save the season for another year, and issues its forecasts for 2022, based on travelers' intentions, stating that this year's visitor numbers could be 73% domestic and 27% foreign, which, compared to 2019, when domestic tourists accounted for 68% and foreign tourists for 32%, tips the balance once again in favor of Spanish travelers.

These figures already take into account both the negative effect of the invasion of Ukraine on international travelers and the positive effect whereby Spain would gain ground over other traditional Mediterranean destinations such as Turkey, due to its proximity to the conflict zone.

In this context, it seems that domestic tourism could once again become the lifeline for some destinations, especially in the short term, since, for both economic reasons and perceptions of safety, less decline is expected, and fear would have less of an impact on domestic travel than the local restrictions imposed by regional governments in each autonomous community as a result of the coronavirus.

And in this scenario, what can destinations and other actors in the value chain do?

- Convey confidence to customers.

- Make booking and cancellation conditions as flexible as possible.

- Containing prices in the face of rising supply costs and their impact on household spending.

- Analyze the collapse of prices among competitors in countries such as Turkey so as not to lose competitiveness.

- Focus actions on the target audience.

- Pay attention to domestic travelers, taking into account the usual flow of travel between communities.

- Focus on countries and regions that bring in the most tourists and the most revenue.

- Continue with the planned transformation.

- Don't despair and become discouraged; these are times for resilience and adaptability.

The good news is that after two years, the desire to travel has not been lost, and the recovery observed until November confirms that, if stability is achieved once and for all, tourism will once again become a key activity for the Spanish economy.

For Angel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST, "Once again, the tourism industry is preparing to weather the storm, this time in the face of the current geopolitical and economic situation, now that we have left the Omicron tunnel behind. Now more than ever, it is necessary for private companies and public administrations in destinations to work on segmenting their target audience, taking into account changes in behavior and travel patterns, offering competitive value propositions, and investing in those segments of high-value travelers who are likely to visit Spain and each particular destination. The challenge lies in gradually recovering demand while transforming the industry, i.e., prioritizing the short term without forgetting the medium and long term. Once again, sustainability will be key and a competitive advantage, not just because it is fashionable, but because it would lead to less dependence on fossil fuels, where prices are expected to rise endlessly, first due to supply from Eastern countries close to the conflict, and then due to the taxes that European governments will impose on this type of energy. Given the strategy to decarbonize the planet, which cannot be forgotten if we want tourism to endure over time, García Butragueño concludes by affirming the importance of flexibility and adaptability in a sector that has proven to be resilient, and which BRAINTRUST helps to create strategies for the future based on the short-, medium-, and long-term environment.