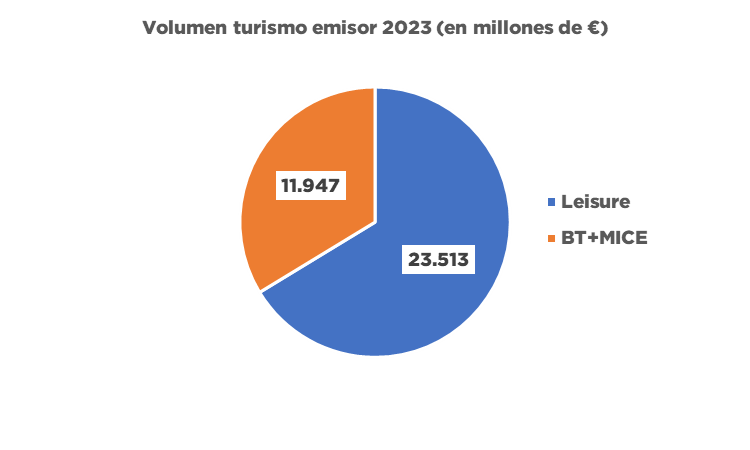

BRAINTRUST, a leading consulting and professional services firm in the tourism sector, has released a new industry report, this time providing a comprehensive overview of outbound tourism in Spain, which is expected to reach €35.46 billion in 2023, with two-thirds corresponding to vacation travel and one-third to business travel and MICE spending.

Spending on outbound vacation tourism continues to rise despite inflation

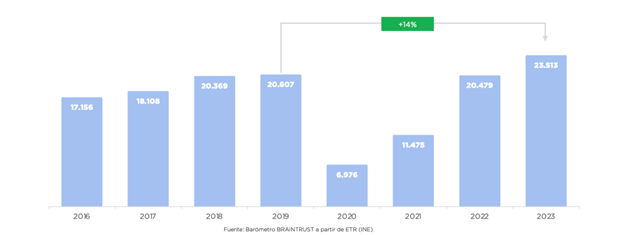

BRAINTRUST estimates that 2023 will see new records in the vacation sector, where spending will grow by 14% over 2019 figures, reaching €23.513 billion. In the business travel sector, the pull of the MICE segment will offset the decline in business travel, reaching a combined figure of €11.947 billion, still slightly below 2019 levels.

However, the number of vacation trips would fall by 4%, from 109 million trips in 2019 to 105 million in 2023, confirming that outbound tourism spending is also being heavily impacted by inflation, which is justifying the increase in turnover.

In total, both segments are expected to reach a total volume of €35.46 billion in 2023, representing 25-30% of tourism revenue. Meanwhile, foreign tourism, which could reach €100 billion in spending in 2023, would account for 70-75% of tourism revenue in terms of its direct impact.

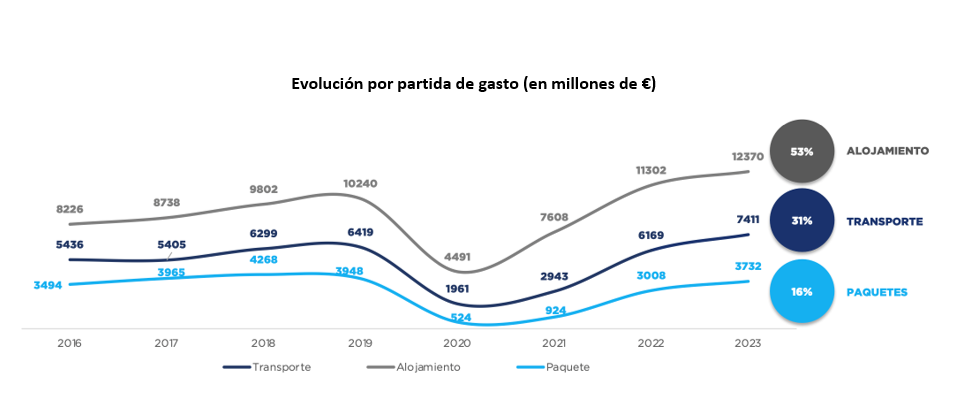

Tourist packages, mostly sold by agencies, reached 3.732 billion, accounting for 16% of total spending.

According to a study conducted by the consulting firm BRAINTRUST, it is interesting to note how Spaniards spend their money when traveling, with accommodation being the largest expense at €12.37 billion, followed by transportation, which accounts for €7.411 billion, leaving packages with a 16% share, reaching €3.732 billion, mostly sold by travel agencies.

Analyzing in depth its variation compared to 2022, which saw spending fall due to the omicron wave in the first half of the year, accommodation would be growing by 9.5% over the previous year, while transportation would grow by 20.1% and tourist packages by 24.1% due to the closure of many countries in the first half of last year.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST:"This year is once again a record year for Spanish outbound tourism, largely due to strong demand, especially in the vacation sector, and also to the high impact of inflation on the average price of travel, as spending growth is around 14% while the number of trips is 4% below 2019 levels.

In terms of business travel, there has been a significant increase in meetings, which are becoming increasingly purposeful and offer a high return on investment. These are compensating for the decline in individual business travel, which is still largely held back by the use of technology for one-to-one interactions and by the effect of corporate social responsibility in light of the high impact of carbon emissions, which are becoming increasingly relevant in view of the objectives of the 2030 Agenda in Europe. Our forecasts remain optimistic, with continued growth in the coming years if there are no geopolitical factors to prevent it, given that travel itself has become a priority in a post-pandemic society that is much more focused on experiences than on accumulating material things. However, we will have to continue to analyze the data on an ongoing basis in the event of any changes that could lead to greater volatility in the sector, but where companies already have appropriate flexibility plans in place, many of which we are involved in, helping companies on their path to transformation."

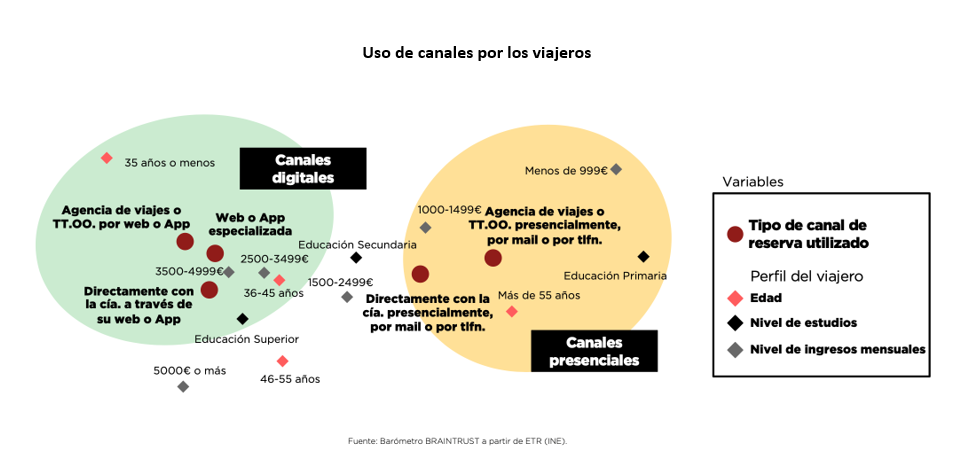

Travelers on digital channels are younger people and/or those with greater purchasing power and/or higher levels of education.

BRAINTRUST conducts a comprehensive analysis of travelers by purchase channel, with travelers using in-person channels being very different from those using digital channels.

Thus, the consulting firm states that the most analog users are mostly people over 55 years of age and/or with a monthly income below €1,500.

On the other hand, there would be younger travelers, under 45 years of age, and/or households with a higher level of education, and/or those with a monthly household income of more than €2,500.

For the consulting firm, this fact once again shows the gradual advance of digitalization among travelers, who prefer to plan their trips from their devices, whether or not they have an expert travel advisor, who must continue to highlight the value of their work as travel agents.

According to Ángel García Butragueño, Director of Tourism at BRAINTRUST: "Adapting supply to demand remains a priority in the tourism industry. The market continues to innovate and evolve, while companies in the tourism sector need to adapt in a way that leaves no room for turning back. Our analysis shows that travelers are becoming increasingly digital, and with that comes the possibility of planning their own trips, especially among younger generations and/or those with higher levels of education and income. Travel agencies have many opportunities and challenges ahead of them, which they must know how to address in order to take advantage of and maximize the industry's growth in the coming years. Among the challenges are disintermediation, talent shortages, the shift from selling products to providing experiences, and sustainability. Opportunities include the growth in travelers, digitization, the value of intermediation itself, and the emergence of new, more efficient business models. Destinations must strive to manage sustainable tourism in high-traffic areas so that tourist cities and towns do not become carousels of visitors that negatively impact residents. Tourism must be a regenerative industry, not only avoiding negative impacts, but also improving destinations and leaving a legacy for local inhabitants.