BRAINTRUST, a leading consulting and professional services firm in the tourism sector, has released a new industry report, in this case a comprehensive overview of the meetings sector in Spain, where it has worked for the Spain Convention Bureau for another year, analyzing national and international demand, how it has changed, and how the range of meeting destinations must transform in the future to remain leaders. The report was funded by the Secretary of State for Tourism.

The meetings industry will reach €10.435 billion in 2022, almost doubling the figures obtained the previous year, and forecasts a volume of €12.1 billion in 2023.

2022 has undoubtedly been the year of recovery for tourism. Although, according to WTTC data, global tourism was still at 63% of its 2019 levels, the main tourist destinations performed significantly better than this global average.

It is a fact that vacation tourism has returned, but it is also true that the meetings and events industry has done so as well, with a remarkable 2022 and optimistic prospects for 2023.

According to data from the Spain Convention Bureau, the network of local entities that currently brings together 63 conference destinations within the Spanish Federation of Municipalities and Provinces (FEMP), Spain closed with a turnover of €10.435 billion, which is only 15% less than in 2019 and practically double what was achieved in 2021.

On the other hand, both existing data and industry experts conclude that face-to-face meetings are back to stay and that the hybrid or virtual component will remain a tool that improves connectivity and sustainability and allows events to be complemented, enhanced, and add value.

Proof of this is that, according to the barometer carried out by the Spain Convention Bureau, more than 80% of meetings will be held in person again in 2023, and it is expected that half of meeting spaces will have an occupancy rate of more than 75% on average per year.

Forecasts indicate that in 2023, this figure could exceed €12.1 billion, approaching pre-pandemic levels and surpassing business travel in the recovery, which is suffering from a greater slowdown, with global recovery not expected until 2025.

Markets close to Spain represent an opportunity to attract more customers by implementing a smart segmentation strategy.

According to a study conducted by the consulting firm BRAINTRUST for the Spain Convention Bureau, which thoroughly analyzes demand in the meetings industry at both the national and international levels, different areas of opportunity for the development of meetings in Spain have been identified. While it is true that the nearby markets analyzed (Germany, the United Kingdom, France, Benelux, Italy, and Portugal) account for almost half of international business volume, there is great potential for growth given the potential that all of them present and the strength of the Spain brand in this industry.

In light of the study, a future horizon is opening up in which Spain's position is, a priori, privileged; but after the "uncorking effect" of the return to normality, there must be a logical and necessary transformation of the offer to meet the needs and purposes of the organizers.

Destinations must take into account the new needs of customers, both organizers and attendees, focused on the one hand on digitization and technologies and on the other on a clear evolution in the experience towards leisure; new locations and venues for the event, as well as other mantras such as sustainability and professionalism in the sector.

By classifying customers according to their specific needs, BRAINTRUST has identified six customer segments recognized for their behavioral attitudes, which are as follows:

According to Ángel García Butragueño, Director of Tourism at BRAINTRUST: "Adapting the offer to the new existing demand involves implementing advanced segmentation strategies, not only by market of origin or sector of activity, but also by understanding the target audience that each destination wants to address based on its strengths and capabilities, and then analyzing where it is and what is the most suitable proposal for each customer, thus increasing the chances of success and ruling out segments or market niches that do not fit with what the destination has to offer.

The evolution towards the "present/future" event involves developing encounters that generate greater connection between attendees through personalized experiences, greater social awareness in terms of both the environment and accessibility and diversity, as well as generating local experiences, which are essential for promoting attendance, overnight stays, and increasing average spending.

In this regard, the Spain Convention Bureau plays a critical role, given its function as an integrator of the offerings of its member destinations and its specialization in promotion and communication, combining efforts and optimizing synergies among all Convention Bureaus and their local partners, a task it performs with great success.

The average daily expenditure of business travelers rises to €335, tripling the expenditure of vacationers.

Inflation, geopolitical conflicts, and rising business costs are challenges that are present everywhere when organizing meetings, as shown in the study in which companies reiterate the need to meet, although they are very price-conscious, which could lead to a change of destination if prices skyrocket.

The companies interviewed state that Spain is one of the best countries for organizing meetings, due to its high level of expertise and flexibility, as well as reasonable value for money compared to other destinations with higher rates such as France, Italy, or the United Kingdom.

The industry itself and all actors in the value chain have long been advocating for the positive impact of this sector, which generates significant revenue, reduces seasonality in demand, consumes scarce resources, promotes employment, and leaves a legacy of wealth in destinations and communities.

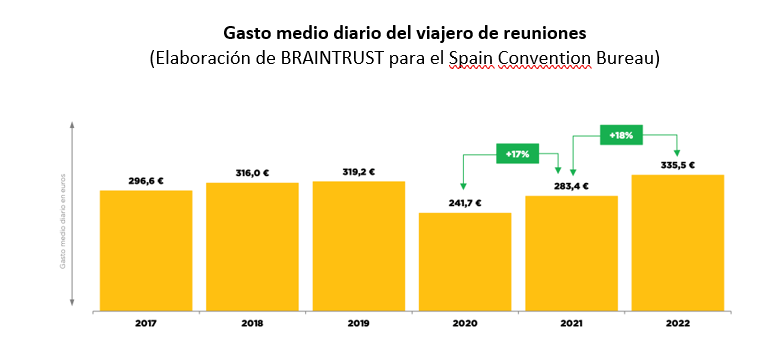

Thus, the average daily expenditure per traveler will rise to €335 in 2022, which, although amplified by the effect of inflation, already far exceeds the expenditure in 2019, when it stood at €319. This average expenditure should convey the urgent need to convey to political bodies and public and private organizations the contribution that meetings make to the economy of destinations, compared to other types of travelers such as vacationers.

A strategy for the future must be designed, reinforcing the critical areas of Spain's offering: its value proposition, talent, message, and brand image.

In the BRAINTRUST study for the Spain Convention Bureau, clients from the countries analyzed expressed the need to improve the offering based on four priority levers:

- Moving from a traditional value proposition to a more innovative and sustainable one.

- Migrating from a continuous, analog professional talent to a renewed, digital talent.

- Enhancing the brand image, shifting from a vacation destination to a destination for meetings, incentives, events, and conferences.

- Customizing the message, modifying the usual segmentation by country or business sector, to a more attitudinal segmentation approach that takes into account the specific requirements of each company.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST:"To carry out this transformation, destinations have a key ally in Marca España.

Our country ranks first in the Bloom Consulting Country Brand Ranking Tourism, while according to Brand Finance's Nation Brands 2022 report, the strength of the Spain brand has grown by 9%, obtaining a score of 72 out of 100 in the Brand Strength Index and an AA brand rating.

This brand value must be transferred to the meetings sector, and the competent tourism authorities are obliged to include this industry among the sector's strategic priorities. In addition, work must be done on the four major areas for improvement identified by domestic and international customers, paying special attention to renewing an increasingly scarce talent pool, enriching and diversifying the value proposition without destinations competing with each other, promoting the Spain brand image over regional or local brands that are not recognized, and personalizing the message to each customer, avoiding mass marketing.

Only in this way will we be able to evolve, progress, and continue to be leaders in a sustainable meetings industry, which is becoming increasingly important in terms of tourism GDP and, consequently, the Spanish economy.