The consulting and professional services firm Andersen Consulting (formerly BRAINTRUST), a leader in the tourism sector, has released a new report from its Tourism Barometer that provides a comprehensive overview of Spanish travel spending, revealing significant changes from previous years, especially in terms of diversification of spending.

Spending on international travel grows by 18% and now accounts for three-quarters of the total, reaching historic highs.

According to an analysis by Andersen Consulting based on data from the INE, spending on international travel has reached historic highs, with €18.095 billion, increasing its share to 34%, while domestic travel reached €35.101 billion, lowering its share to 66%. This is the result of a new generation of travelers with greater technological and language skills and less risk aversion, aided in large part by travel agencies, which are increasingly specializing in medium- and long-haul travel, highlighting their high advisory capabilities.

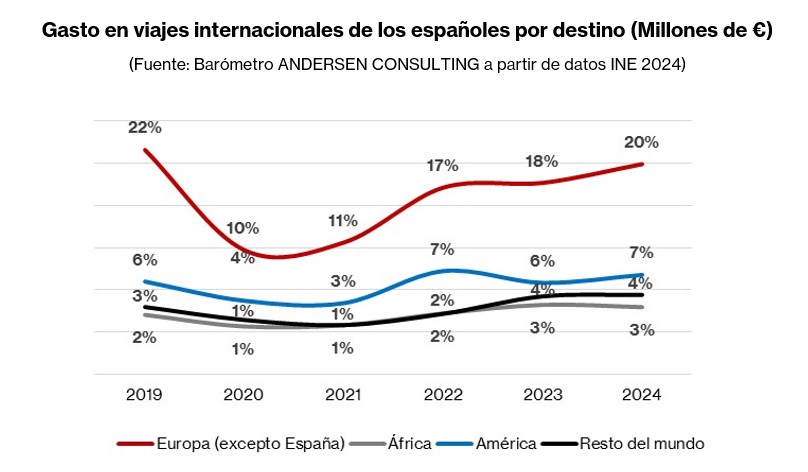

Of the aforementioned 34% of international spending, 20% would be to European countries, 7% to America, 3% to Africa, and 4% to the rest of the world.

Spending on packages rises 14%, driven by an increase in international travel

Andersen Consulting takes an in-depth look at the products purchased by Spaniards, where accommodation continues to account for the majority of spending with a 51% share, although this expenditure has stabilized after the sharp price increases experienced in recent years, leading to a decline in market share from 53% to 51%.

Transportation expenses would account for 30%, while parcel expenses would reach 19% of the total, growing 14% compared to the previous year.

The growing internationalization of travel allows packages to gain weight in the purchase of trips by Spaniards, a trend that, if nothing prevents it, will continue to rise in the coming years.

According to Ángel García Butragueño, Tourism Partner at Andersen Consulting: "At Andersen Consulting, we continue to focus on the variations in the Spanish market in terms of purchasing behavior, following a trend of constant growth and greater internationalization of spending, as we predicted a few years ago.

Travel has become a way of life rather than a status symbol, and this can be seen in the pursuit of unique and different experiences. Spaniards, who are more educated and digitally savvy than ever, are seeking out increasingly distant destinations, trying to learn about new cultures and new ways of looking at life, enriching their existence and confirming our idea that we are moving towards a more humanistic society, where being is gaining ground over having. another trend that will continue to grow in the coming years, as reflected in the sales of intangible goods (on the rise) versus tangible goods (on the decline).

In this context, both traditional and online travel agencies continue to demonstrate their ability to advise travelers who are less risk-averse and need experts to design trips that are out of the ordinary. Intermediation will continue to gain ground in this type of travel, where added value throughout the customer journey really makes the difference, as opposed to planning the trip yourself.

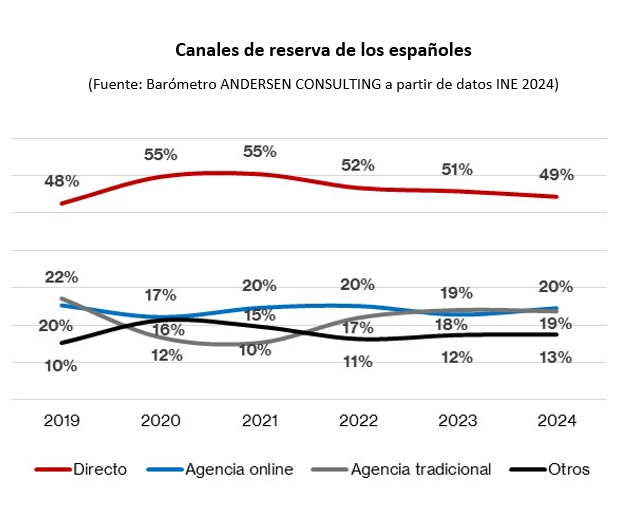

Although direct channels remain the majority, they have fallen by 2 points, revealing the importance of valuable intermediation.

This snapshot, revealed by Andersen Consulting's Tourism Barometer, also shows some changes in behavior with regard to booking channels.

The direct channel is losing relevance, falling 2 points, to the detriment of intermediation. On the one hand, OTAs are growing from 18% to 20%, while traditional agencies remain stable at 19%. These variations seem to show that direct sales are mainly used for short-haul and/or low-complexity trips, and that online travel sales continue to grow, given the increasing use of technology and its greater capabilities in the sale of tourism services.

Travel spending is polarized, with higher-income households spending up to 26% more, while lower-income households significantly reduce their spending, falling by 14%.

Finally, Andersen Consulting reveals the well-known relationship between travel spending and household income. Although travel is not a basic necessity, it has become part of the DNA of both the younger generations who have grown up traveling and the older generations who, with more time and greater purchasing power, can afford leisure activities related to travel.

Thus, Spaniards under the age of 35 account for 25% of total spending, while those over the age of 55 account for 30%, with spending by those over 65 growing by 14%. This would leave the middle-aged group, between 36 and 55 years old, with 45% of total spending, data that should help tourism companies design their products according to market needs.

The report also highlights that women account for 54% of total travel spending, leading the way in organizing vacations in households.

Finally, the consulting firm highlights the polarization of travel spending according to household income, with low incomes below €1,500 per month accounting for 12% of the total and decreasing by 14%, and on the other extreme, households with higher incomes above €3,500 per month accounting for 36% but growing by 26%, leaving middle-income families between €1,500 and €3,500, accounting for 48%.

According to José Manuel Brell, Managing Director and Partner at Andersen Consulting: "At Andersen Consulting, we have been communicating our travel expenditure analyses to the market for some time now, so that tourism companies can anticipate future trends. Today, we can say that each and every one of the trends we have been announcing is coming true.

This fact once again highlights the importance of analyzing data rigorously and accurately, applying it to the business, and helping our clients chart the course for the coming years.

Focusing on opportunity seems key to us for those providers who want to get their strategies right, such as, for example, the growing relevance of travel niches, such as higher-income households or people who have more time to travel, given that the relationship between household purchasing power and the number of trips, the type of trips, and even the channel, is increasingly strong.

We are therefore delighted to announce that we have created the Andersen Consulting Tourism Intelligence Hub (HITAC), where we will put all our knowledge and experience at the service of an industry that continues to grow and which, by 2030, will account for around 12% of the global economy, reaching 15% in Spain in the coming decades, once again becoming the driving force behind our country's economy.