BRAINTRUST, a leading consulting and professional services firm in the tourism industry, has released a new industry analysis, this time focusing on the channels used by Spaniards to purchase travel, specifically package tours, thanks to a new wave of its Tourism Barometer in collaboration with CEAV (Spanish Confederation of Travel Agencies). It states that the decision to use brick-and-mortar agencies or online agencies (OTAs) varies depending on the origin, destination, age, and gender of the traveler, with notable differences detailed in its new analysis.

OTAs dominate among young people, while brick-and-mortar agencies dominate among older people.

BRAINTRUST continues its analysis of the sector, with the aim of helping the tourism industry to recover and transform itself. The consulting firm states that when purchasing tourist packages, Spaniards choose channels according to the age of the travelers. While 67.9% of those over 45 use brick-and-mortar agencies, only 40.0% of those under 45 use them for their trips. In the case of OTAs, the data is the opposite: while young people use them for 60.0% of their trips, older generations use them for only 32.1%. In terms of spending, traditional agencies account for 71.2% of baby boomers and Generation X, while millennials and Generation Z account for 53.8% of spending. In the case of OTAs, the opposite is true, with older people accounting for 28.8% of spending compared to 46.2% for younger people. To understand a little better the behavior of travelers in terms of the purchase channel, it is worth noting that the average cost of a package at a brick-and-mortar agency is €496, while at an OTA it is €339, due to the destination component in each case.

For Carlos Garrido, President of CEAV: “The need for agencies for Spanish travelers is clear, as we have been arguing and defending in recent years, in the midst of the pandemic. Whether offline or online, agencies provide irreplaceable value, advising travelers on their travel needs, especially in the VUCA environment of volatility, uncertainty, complexity, and ambiguity that we are currently experiencing, where we are likely to leave the pandemic behind but may face other unexpected events. At CEAV, we continue to provide solutions and expand opportunities for the creation and maintenance of agencies in Spain, whose dominance in the sale of package tours is overwhelming.”.

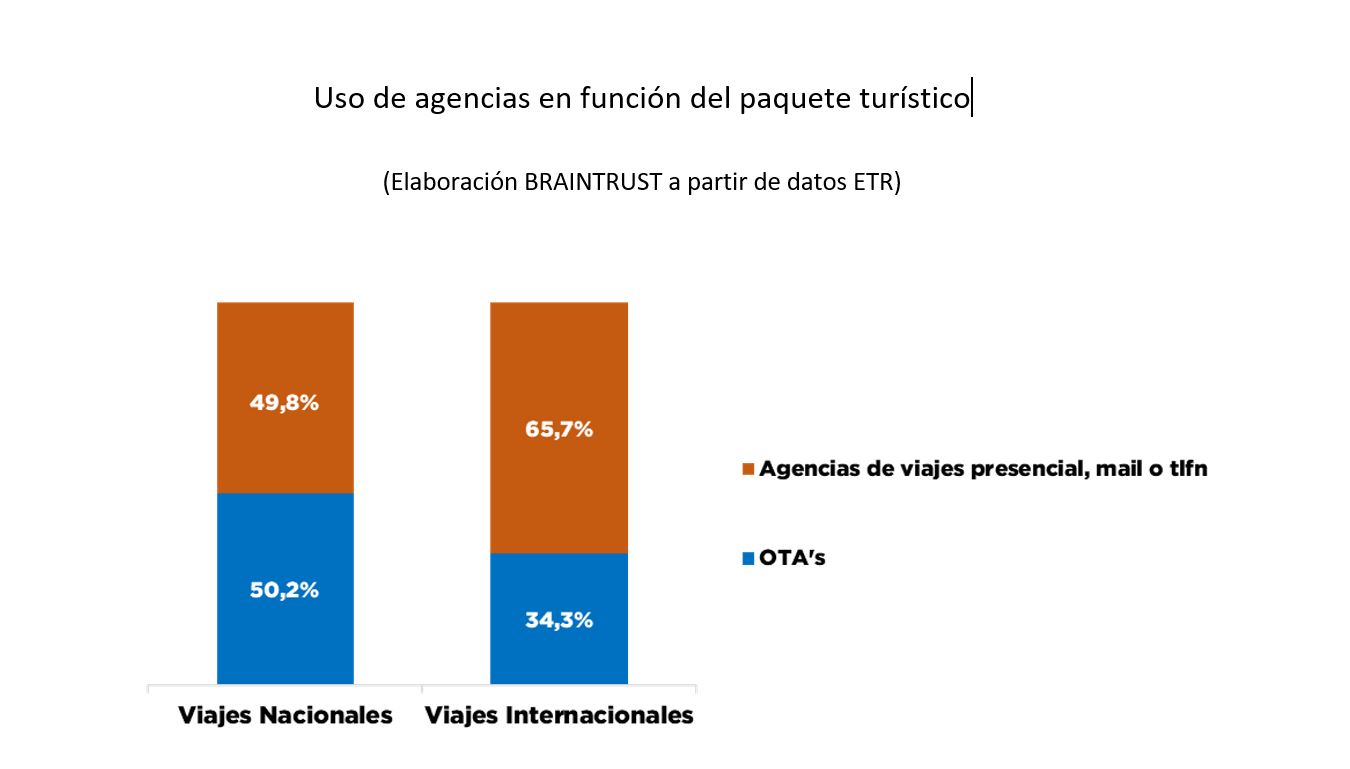

International travel, the domain of brick-and-mortar agencies

Analyzing the data separately, BRAINTRUST highlights the clear difference in the use of different channels, whether for domestic or international packages. Thus, for international packages, 65.7% are purchased through a physical agency, compared to 49.8% for domestic packages. This confirms that the "people effect" is fundamental when it comes to traveling beyond our borders, where Spanish travelers like to be attended to by travel consultants for their valuable advice, and in the event of any eventuality that may arise during the trip, which, according to travelers, are not uncommon at this time of year, and where a person can resolve issues quickly and efficiently and, above all, in a more humanized manner, which is important in an emergency context.

Extremadura, Castile and León, Galicia, Andalusia, and Madrid, strongholds of brick-and-mortar agencies. Catalonia, La Rioja, Navarre, the Balearic Islands, and the Basque Country, strongholds of OTAs.

The new wave of the BRAINTRUST Barometer, in collaboration with CEAV, also delves into the booking channel by traveler origin, revealing significant differences. Extremadura leads the way in the use of brick-and-mortar agencies for purchasing package tours with 82.9%, followed by Castile and León with 73.2%, Galicia with 72.9%, Andalusia with 68.6%, and Madrid with 63.8%. At the other end of the scale, with very significant differences, are Catalonia, with 29.1% using physical agencies to purchase packages, La Rioja with 39.4%, Navarra with 42.0%, the Balearic Islands with 49.5%, and the Basque Country with 50.4%. Cultural aspects, as well as accessibility and the number of agencies, could be driving these differences, which should help intermediary companies measure and define their strategies for expanding and/or reducing points of sale, based on travelers' behavior patterns.

According to Angel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST: "As we have been anticipating in our Tourism Barometer for several years now, travel agencies are a highly valuable channel in the tourism industry, and they dominate the sale of tourist packages by a wide margin. However, the types of agencies used vary greatly over time, with criteria that should be observed and where intermediary companies must evaluate their service channels if they want to remain viable in the future. There is no doubt that it is very important in these times to define a strategy for optimizing the channel mix with rigorous criteria and numerical data to support decisions. In this regard, at BRAINTRUST we are helping all intermediaries, both Vertical Groups and Management Groups and Travel Agency Associations, to develop optimal distribution plans according to the segments they target and the type of travel they market. The future will show that intermediaries have a fundamental and incalculable value in the sale of package tours, even though formats and channels may change forever. The reality is that today's travelers can use many channels simultaneously, practicing omnichannel marketing, as our analyses show.

Gender, another important variable when choosing the purchasing channel

Finally, the latest wave of the BRAINTRUST Barometer analyzes whether there are differences in travelers' consumption patterns in terms of gender, stating that 55.9% of women choose brick-and-mortar agencies to purchase package tours, compared to 50.5% of men.