Según los datos del estudio “2025, una mirada al futuro de los viajes de negocio” realizado por GEBTA y BRAINTRUST, las variaciones que se van a producir en el tejido empresarial español, tanto en número de compañías existentes y empleados por compañía, como en su manera de operar, van a determinar la fisonomía y el tamaño del sector de los viajes de negocios en los próximos años.

Según Ángel García Butragueño, Director de Turismo y Ocio en BRAINTRUST y autor del estudio, “Sabemos que la situación de la economía española y su impacto directo en el funcionamiento de las empresas es uno de los factores que más influyen en el desarrollo de los viajes de negocio, pero también lo es el cambio cultural y del modo en el que se organizan los procesos. Ahora que podemos predecir en cierta medida cómo va a ser este cambio, los actores del sector deberían cambiar ya su forma de operar, apostando decididamente por la tecnología, incluyendo la maximización de la utilización de herramientas de auto-reserva, el uso de app’s, e integrando nuevos partners implicados en la gestión de viajes de principio a fin, desarrollando potentes servicios de asesoramiento, consultoría y análisis que construyan una propuesta de valor muy apoyada en la mejora del negocio y no en la ejecución de transacciones. Este cambio ayudará a las empresas españolas en su camino de la competitividad frente a otros mercados de nuestro entorno, en un contexto de incertidumbre y volatilidad, en el que las compañías que apuesten por la eficiencia y la excelencia serán las claras ganadoras en un mundo globalizado”.

Se crean más empresas pero más pequeñas. El tamaño medio de la empresa española frena una mayor presencia exterior.

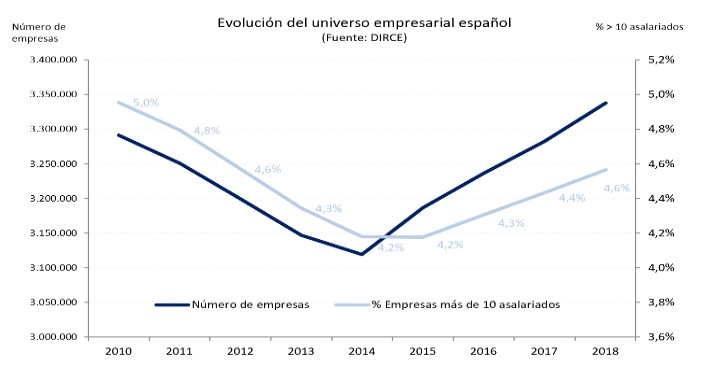

En 2010 el número de empresas en España se situaba en 3,3M. Influido por la crisis económica el tejido empresarial español comenzó a descender a partir de ese momento hasta alcanzar su cifra mínima en 2014, con un total de 3,1M.

Aunque a partir de ese mismo ejercicio el número de compañías en España inició su recuperación y se ha situado de nuevo en los 3,3 M en 2018, el tamaño medio de las empresas pasada la crisis es inferior al de 2010.

“Con un tamaño medio de 4 asalariados por compañía resulta difícil abordar procesos de internacionalización y mantener la actividad exterior de modo regular, esto es, durante más de 4 años seguidos. De hecho, aunque desde el año 2013 ha habido una progresiva incorporación de las pymes y micro pymes a los viajes de empresa, su presencia resulta todavía reducida en términos relativos y sugiere oportunidades de crecimiento futuro”, indica Marcel Forns Bernhardt, Director de GEBTA España y coautor del estudio.

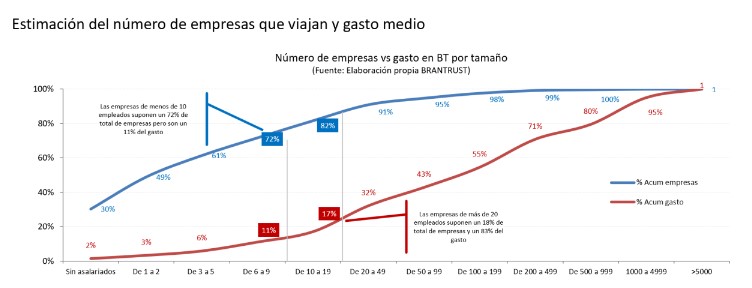

El 18% de las empresas actuales acumulan el 83% del gasto en viajes

El universo real de empresas que impactan actualmente en el mercado del business travel está excesivamente acotado. El 83% del gasto total de viajes se concentra en las empresas con más de 20 empleados (el 18% del total), mientras que las empresas con menos de 10 empleados (el 72%), la gran mayoría de nuestro mercado, sólo son responsables del 11% del gasto total.

El 67% de estas compañías con más empleados se concentran en 5 Comunidades Autónomas y el 63% en 5 sectores principales lo que indica que el mercado productivo español está altamente concentrado.

Teniendo en cuenta que las proyecciones de crecimiento del parque empresarial en el año 2.025 se sitúan en el entorno de los 3,6M de compañías, lo que supone un crecimiento aproximado del 7%, a efectos de los viajes de negocio el tamaño medio de las empresas resultará un factor determinante.

De acuerdo con las previsiones que recoge el estudio “2025, una mirada al futuro de los viajes de negocio”, de este conjunto de 3,6M de compañías, aproximadamente un 5%-6% tendrán un volumen de asalariados superior a los 10 empleados, con un tamaño medio ligeramente superior al actual.

El tamaño importa, pero no es el único factor determinante. Tecnología y especialización son clave para optimizar la inversión en viajes.

Para elaborar las proyecciones de crecimiento de los viajes de negocio en España en 2025, el estudio elaborado por GEBTA y BRAIN TRUST analiza además los factores de contexto y las principales variables económicas que condicionan el negocio.

“La forma de trabajar de las empresas cambiará radicalmente, lo que impactará de lleno en la gestión de sus viajes de negocio. Por un lado, la forma de organizar el trabajo y los procesos productivos darán un giro de 180º debido a la digitalización. Equipos más pequeños, deslocalizados, más exigentes con la rapidez de los procesos serán habituales, del mismo modo que veremos una mayor orientación a las personas (empleados, clientes, partners, etc).

El sector del business travel se enfrentará a un nuevo perfil de responsables o gestores de cuentas de viajes mucho más acostumbrado a lo digital y a la presión permanente en búsqueda de la eficiencia”, indica Ángel García Butragueño..

Las agencias de viaje, en constante evolución, tendrán como misión ayudar a las empresas a gestionar de forma óptima sus desplazamientos, y por tanto a ser más competitivas, apoyándoles en su eficacia y productividad, contribuyendo de este modo a hacer crecer sus negocios y mejorar sus márgenes, a través de programas de optimización del gasto en viajes, procesos eficientes e integrados y adopción de herramientas tecnológicas de última generación.

La digitalización y el recurso a especialistas constituyen elementos clave para garantizar el uso eficiente de la segunda partida de gasto indirecto, a la vez que para asegurar políticas de seguridad y prevención adecuadas.

Ambos elementos son clave para las empresas.

Para José Manuel Brell, Socio y responsable de la práctica de Estudios y Modelos Cuantitativos en BRAINTRUST, y autor del estudio, “La tendencia apunta a que en 2.025 el sector del business travel estará conformado por un conjunto de procesos integrados muy apoyados en la tecnología, con flujos absolutamente automatizados donde las necesidades se vincularán a la mejora del negocio y a la rentabilidad. Si las compañías turísticas toman el liderazgo de este cambio podrán hacerse no solo con la ventaja que da el ser el promotor del cambio sino con la capacidad de dirigir esta transformación hacia los estándares que considere más adecuados para su negocio, ayudando en su misión, a la digitalización del tejido empresarial español, y con ello a su competitividad en un mercado cada vez más abierto, difícil y complejo”.

Posible escenario para el Business Travel en España.

Dependiendo de la combinación de los distintos factores indicados – y sin menoscabo del entorno global -, la inversión en viajes de negocio en España se moverá entre los 15.000 y los cerca de 16.000 millones de euros en 2025. En un escenario moderado el sector del Business Travel habrá crecido en torno a un 22% acumulado, llegando hasta los 15.200 millones de euros.

“La diferencia puede parecer poco relevante en términos de crecimiento relativo anualizado (del orden del 3%), pero si tenemos en cuenta que existe una correlación entre la inversión en viajes de negocio y la actividad comercial, que en la actualidad se mueve en una proporción de 1:10 (10 euros por cada euro invertido en viajes) y 1:6, dependiendo de si hablamos de exportaciones o de mercado interior, la distancia entre el escenario más bajo y un escenario óptimo de 16.000 millones de euros podría generar un impacto equivalente al 0’5% del PIB español”, afirma Marcel Forns.

Conclusiones y recomendaciones

La gestión de los viajes de negocio en España por parte de las empresas tiene todavía recorrido para madurar. Una buena gestión del viaje de empresa es fundamental para el crecimiento del negocio de las compañías, y por extensión de la economía en su conjunto.

En el caso de España, el estudio “2025, una mirada al futuro de los viajes de negocio” realizado por GEBTA y BRAINTRUST pone de manifiesto la existencia de una gran oportunidad de mejora, que puede llevar asociada un aumento del PIB generado (directo e indirecto) del orden del 0’5%.

Para el adecuado progreso de maduración de los viajes de empresa en España, GEBTA y BRAINTRUST destacan las siguientes recomendaciones básicas:

- Con independencia de la evolución del escenario global, las empresas españolas deben prepararse para poder competir en los mercados internacionales en condiciones óptimas. El tamaño medio de las compañías en España sugiere la conveniencia de impulsar políticas adecuadas, que promuevan el crecimiento medio de las pymes. Una mayor dimensión de las estructuras de las pequeñas y medianas agencias constituye un requisito básico para poder afrontar y mantener procesos de internacionalización del negocio.

- La digitalización es un elemento clave para la optimización de la partida de viajes, que supone de media la segunda mayor partida de gasto indirecto. De modo generalizado las empresas españolas necesitan apoyarse en la tecnología para hacer más eficientes sus procesos, gestionar de modo adecuado la información, y mejorar su competitividad. Sin la tecnología adecuada no sólo se pierde eficiencia, sino que las empresas corren el riesgo de perder el acceso a las mejores tarifas disponibles.

- Para impulsar los procesos de digitalización y eficiencia de los procesos asociados al viaje es recomendable que las empresas se asesoren en agencias de viajes especializadas. La externalización de la gestión es un elemento fundamental para la contención del gasto y la optimización de las inversiones, pero también para una adecuada gestión de la seguridad y prevención de los viajes y desplazamientos.