As part of our ongoing efforts to understand the Spanish traveller market and help tourism companies realise the opportunities, we are launching the new NextGen Barometer, which analyses the travel behaviour and attitudinal profile of Spaniards born after 1980, i.e. exclusively Millennials and Z's, (compared to generations X and Y, born before 1980).

"Young people are transforming the travel industry today, and will do so even more in the coming years. We must begin to understand these profiles, how much they spend, how they are inspired, what motivates them when booking their trips, what travel formats they prefer, what channels they use, what products they consume and what they demand from the sector's agents. Only in this way will we be able to anticipate their needs and offer them a personalised and differential offer. An offer that responds to their high expectations and demands, as this is a highly technological profile, used to having everything here and now, and not very tolerant to frustration, which makes them less loyal customers and more prepared and independent than previous generations", says Ángel García Butragueño, Co-Director of the Tourism Barometer and Head of the Tourism and Leisure Division of BRAINTRUST, which advises tourism companies on the knowledge of travellers.

Youth travel spending is growing above market average

Among the study's findings is that NextGen travellers are the most willing to purchase and consume leisure travel. More than 60% have given ratings of seven or more, compared to 54% of the rest of the generations, which puts the leisure travel consumption forecast index (LVCPI) at 67.6 (that of the rest of the generations is set at 63.4).

This year, young Spaniards will make an average of 2.8 trips with an average budget of €683. This figure represents an increase of 6.1% compared to the previous year (compared to an increase of 4.1% for the rest of the generations).

NextGen make more but shorter journeys

With an average duration of just over a week, the report shows that 47% of these travellers will make at least 3 trips per year, with 71% enjoying more than 2 trips per year.

With this approach in mind, the duration of their trips will be shorter compared to other travellers, with a residual percentage using more than 3 weeks per trip, 5%, while the remaining 95% will spend less than 3 weeks.

Specifically, 13% will enjoy 2 weeks, 30% a week and 52% less than a week, always with the aim of making as many trips as possible, within a concept of global and travelling generations such as Millennials and Z's.

It is also worth noting the low seasonality shown by the NextGen, with only 38% travelling in the high season, while 62% travel outside of the high season, presenting a magnificent opportunity for the entire tourism industry in its ongoing quest for deseasonalisation.

They like to travel for many different reasons

Motivated by different reasons, the NextGen lead each and every one of the arguments for travelling, being the interest in knowing a new place (83%), the recommendation of friends and family (60%) or the information they have seen on the internet (42%), the main reasons, leaving behind any type of advertising either on television, cinema, magazines, blogs or social networks, which should make marketing departments reflect on their investment for this type of public. In this sense, young people are the ones who spend more time dreaming and planning their trip, phases to which they allocate more time than other travellers.

Spain is too small for them and they want to see the world

These trips by NextGen travellers will be international in nature, with 32% of them going abroad compared to 26% of all other travellers.

Among the national destinations chosen by travellers this year, Andalusia (26%), Madrid (19%), the Basque Country (12%), Catalonia (11%) and the Canary Islands (11%) will stand out. Behind them are destinations such as Galicia, Castilla y León and the Balearic Islands.

In Europe, Portugal, Italy, the United Kingdom, Germany and Greece will be the most popular destinations for young people, while the United States and Japan will be the most popular destinations for those who want to travel further afield.

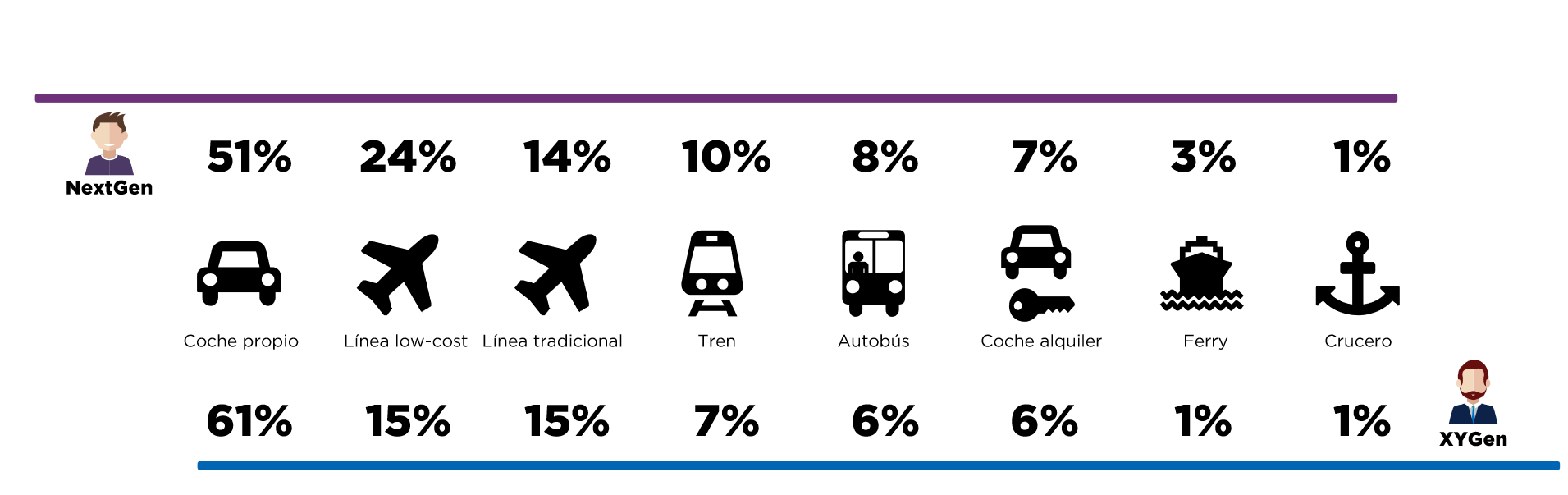

This choice of places is closely related to the way the new generations travel, because although the car is the most commonly used means of transport, low cost airlines, trains and buses are the most differential means of transport.

Booking formats and channels are changing

Unlike generations X and Y, the NextGen use a greater number of sources of information to prepare their trips, among which friends and family stand out with 59%, opinion and destination websites with 51%, followed by travel guides, specialised blogs, travel agencies and social networks.

During the search and booking process, they use mobile phones more than other age groups, with 3 uses on average compared to generations X and Y with 2 uses on average, and they do so mainly to see recommendations and read other people's experiences (60%), book accommodation (52%) and see photos of other travellers (40%).

On the other hand, these younger generations are banishing the traditional package tour format, relegating it to a marginal 9% as an option, compared to the dynamic package with 13%, and single services which are winning the battle with 71%, confirming the preponderance of the "do it yourself" format of people under 40, a fact that should make the industry consider how to approach these generations in order to achieve their loyalty.

In this context, the study shows that they are beginning to forget the traditional itinerary and are opting for specialised and personalised itineraries with 79%, either themed, where films and television series influence with their filming scenarios, or the old "fly & drive" with 71%, which is once again taking centre stage with younger people.

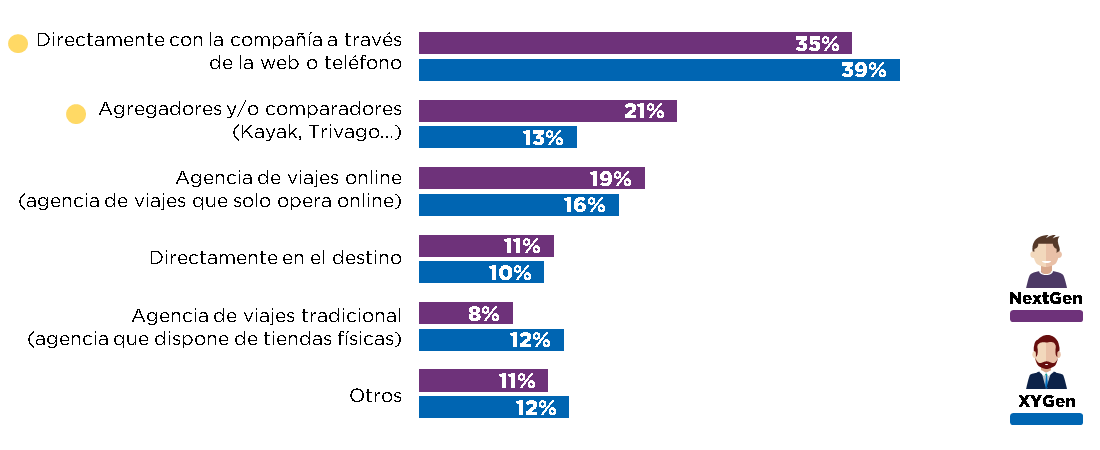

In terms of booking channels, the online channel is the majority for the NextGen generations, with online agencies and search engines and aggregators accounting for 40% of the total, with face-to-face agencies being used by only 8%, while the direct channel, both at origin and destination, accounts for 46%.

And they are not very loyal to destinations and brands.

Finally, the NextGen Barometer points out the low loyalty of the new generations in their behaviour, because only 29% of these travellers are loyal to a specific destination, and only 54% are loyal to the type of accommodation. The result of this is the low brand recall among travellers, data that BRAINTRUST has already published in previous Tourism Barometers.

For José Manuel Brell, Co-Director of the Tourism Barometer and Head of Studies and Quantitative Models at BRAINTRUST "tourism companies must know and identify the behaviours shown by new travellers in order to be able to influence them in the decision and consideration phases, and subsequent booking and enjoyment of the trip, as well as in their ability to make recommendations. Bearing in mind that these new generations are radically changing the way they travel, and that they are not very loyal to brands, the ability of tourism companies to create loyalty among them seems to be an important challenge to solve, and BRAINTRUST helps them in their objective".