Despite the low economic and social forecasts for the coming months due to the COVID-19 crisis, many Spaniards are still willing to travel and enjoy new destinations, as long as the security conditions regarding the pandemic and possible restrictions on mobility allow it. BRAINTRUST has elaborated, thanks to a new wave of its Tourism Barometer, a radiography of these travellers, how they are and how they will travel.

Economic forecasting as a key factor in deciding to travel this year

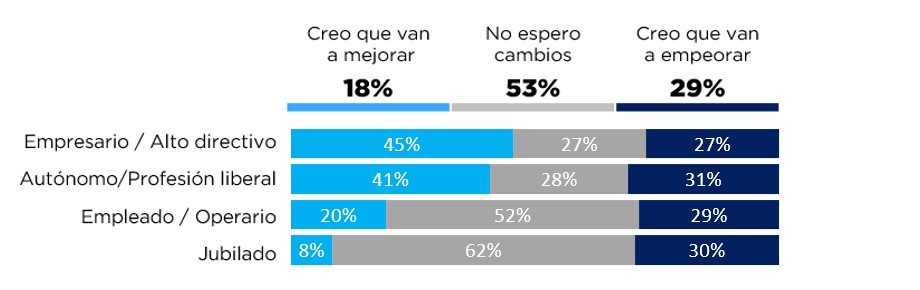

As a result of the current situation caused by COVID-19, fear of the virus has become a key factor when making the decision to travel, with 42% of Spaniards declaring that they are hesitant to travel because of the health situation and fear of contagion. However, 20% of travellers also express a high level of concern about the economic situation and the crisis we are facing. Overall, data from the Tourism Barometer prepared by BRAINTRUST conclude a high degree of pessimism regarding the economic situation in the coming months. While it is true that more than half of Spaniards expect no change in their situation (53%), pessimists with 29% outnumber those who believe that the situation will improve by the end of the year, which represent only 18% of the total.

In a view by type of worker profile, we find some differences with regard to the belief of how the economic environment will develop after the pandemic. The self-employed are the ones who most expect a worsening of their situation, while the most optimistic are entrepreneurs and, on the other hand, employees and pensioners expect their situation to remain unchanged in the future.

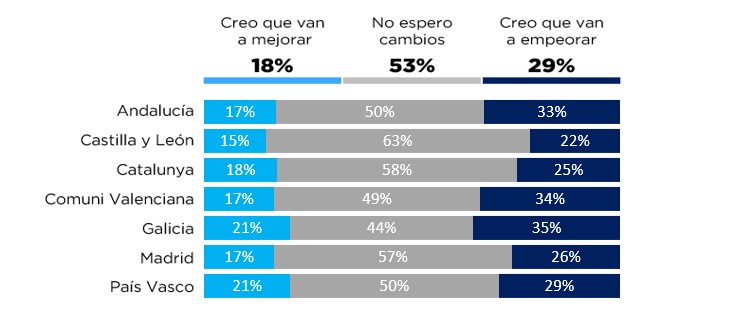

The origin of the traveller also gives rise to differences in optimism or pessimism regarding the economic environment and, therefore, gives us a clue as to those with a greater propensity to travel in the remainder of 2020. In this sense, the Basques and Galicians (21%) are the most optimistic about future economic forecasts, although the latter also have one of the highest rates of pessimism (35%), along with the Valencian Community (34%) and Andalusia (33%).

Profile of the Post COVID traveller and how they will travel after summer

Despite the circumstances surrounding us, 25% of Spaniards still intend to travel after the summer and during the remaining months of 2020. This figure represents a decrease of almost 3 points compared to the same dates last year, with the negative consequences for the tourism, hotel and restaurant sector. For this reason, BRAINTRUST warns of the vital importance of knowing the profile of these travellers, who they are and what they will do, in order to offer them the guarantees they need so that they do not stop travelling after the summer, as long as the conditions and the evolution of the pandemic allow it.

The data provided by BRAINTRUST through its Barometer, allows us to outline the profile of those who, despite the current circumstances, do not want to stop travelling. This traveller would be between 18 and 30 years old (33%) or between 40 and 55 years old (32%) and would come mainly from Castilla y León (37%) and Madrid (43%). On the other hand, this is a traveller profile for whom risk is not a major deterrent when making decisions (40%) and who has also had to cancel a trip this 2020 (39%).

According to Ángel García Butragueño, co-director of the Tourism Barometer and head of Tourism and Leisure at BRAINTRUST: "It is increasingly important for tourism companies to make decisions based on knowledge of the market and how travellers are changing. All suppliers are working hard to have post-COVID protocols in place, an essential requirement at this time, but there is already an impact of the economic crisis that is affecting consumers, who decide to travel or not, not only because of the fear of contagion but also because of the economic uncertainty in their homes".

Favourite post-summer destinations

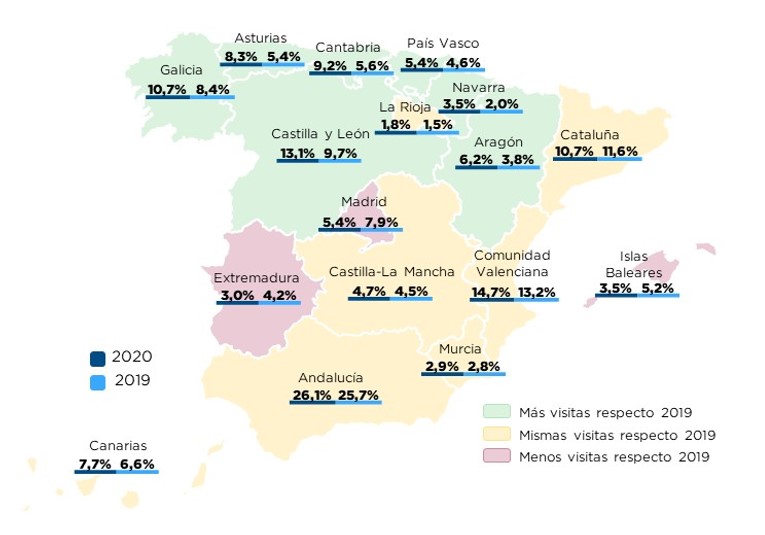

As for the destination of these travellers, and always depending on the mobility regulations that will be established from now on, 14% would choose European destinations and only 4% would travel to other points outside this territory. As might be expected, a large majority, representing 82% of Spaniards, would prefer to stay in Spain to enjoy their holidays. In this sense, the autonomous communities that would gain travellers compared to last year are Galicia, Asturias, Cantabria, the Basque Country, Navarre and Aragon, while those who stand to lose some of their share of travellers are Madrid, Extremadura and the Balearic Islands.

The budget plummets and channels multiply

Another important aspect of this so-called post-Covid traveller is the budget they plan to spend on their holiday. BRAINTRUST statistics predict a significant drop compared to 2019, from around 900 euros on average to 780 euros, caused mainly by changes of destination, which will be more national and by the duration of the trip, which will also be reduced for the same reason.

Analysing the sources that tourists use for inspiration when preparing a trip, it can be seen that those most likely to travel after this summer will use more channels for information, motivated by the current circumstances that require more information about the destination, such as limits on permitted capacity on beaches, in restaurants, etc., as well as health measures and other restrictions. This traveller will rely more on specialised blogs (26%), travel guides (36%) and opinion websites (38%).

In terms of the type of booking channel, some changes are worth highlighting if we compare the situation with last year. Direct contact with the company continues to be the most used channel, although it has lost weight compared to 2019 (38% vs. 33%), together with comparators and aggregators, which also experienced a strong increase (16% vs. 31%). Online travel agencies also gained share (17% vs. 20%) and traditional travel agencies managed to practically maintain their share, losing only two points compared to last year's data. Single services will be the most sought after by travellers in these channels, well above the rest of the types of travel (68%), as well as dynamic packages (19%), while organised packages are losing prominence as they are related to the crowds that travellers nowadays try to avoid (10%).

Changes in accommodation and transport

Focusing on the types of accommodation that will be of most interest to the new traveller, as BRAINTRUST has already mentioned in previous articles, we find a greater preference for family or friends' homes (21%) and rented houses (19%), although the biggest increases are found in second homes (15% vs 3% in 2019) and rural hotels (12% vs 7%). The most affected will be hotels in urban areas, dropping from 30% to 17% in 2020.

The way in which this tourist profile is going to travel from now on will also be affected, to a large extent by the new destinations chosen, which, being more national, will lead to a greater use of private cars, with 64% compared to 58% last year. Motorhomes, as we have seen in the media lately, are also experiencing a higher demand (3% vs. 0.1%). On the other hand, airlines are going to be affected with a drop of two points in the case of traditional airlines (13% vs. 15%) and six points in the case of low cost airlines (12% vs. 18%).

For José Manuel Brell, co-director of the Tourism Barometer and partner in charge of the Quantitative Studies and Models practice at BRAINTRUST: "Autumn is not lost and we have to save what is left of the tourist season with domestic travellers, it is the responsibility of tourism companies to know who these travellers are, and adapt the value proposition to the new times. The physiognomy of the trip they are looking for is radically different from last year, and in this sense, companies in the sector cannot just wait, but must adapt to the new post-COVID times, knowing that some habits and behaviours are here to stay".