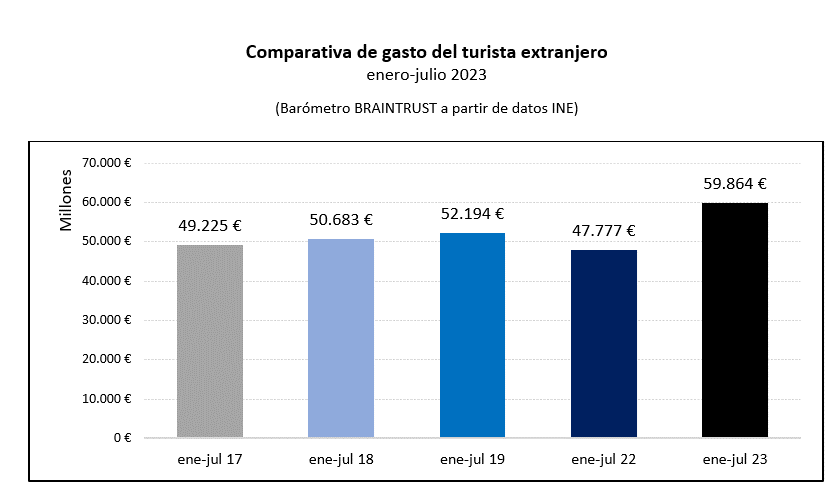

BRAINTRUST, a leading consulting and professional services firm in the tourism sector, has released a new industry analysis, in this case on foreign tourism spending through July, highlighting that the increase in average spending by foreign travelers (+15.6%) equals price inflation in Spain (+15.9%), based on data from 2023 compared to 2019.

Thus, BRAINTRUST's analysis shows that, although spending has skyrocketed, the effect of inflation is the main reason for this increase.

In fact, the consulting firm highlights that the number of trips will fall by 0.77% in July compared to 2019, although the average stay will increase from 6.97 nights in 2019 to 7.16 in 2023.

The rise in average spending matches inflation

BRAINTRUST takes a closer look at foreign travel spending by analyzing changes in consumer behavior, comparing data up to July 2023 with 2019, the year before the pandemic.

Thus, the consulting firm states that the main reason for the increase in foreign tourism spending is not due to a greater influx of tourists from outside our borders, but mainly due to price increases, which, according to INE data, rose by 15.9% in July 2023 compared to July 2019.

Total spending would rise to €59.864 billion from January to July this year, compared to €52.194 billion in 2019, with a 14.7% increase in total spending, which contradicts some official statements that this year will see record spending thanks to higher-quality tourists.

According to Ángel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST: "The results will be another record year, but behind them lies a significant fact: that after the pandemic, we have not improved the model, and it is only thanks to inflation that foreign tourism spending is rising. Personally, I believe that there is much to be done after the pandemic—which we all ventured to say would be a very useful period of reflection, and yet it seems that we have learned nothing—because the model suffers from the same precariousness as always, and is geared toward the number of tourists rather than their quality. Once again, our industry continues to demonstrate its strength, generating 15% of employment in Spain and 12% of GDP, but that will not be enough in the coming years, when new travelers will be looking for different destinations, with different models and diverse offerings. There is no time to lose if we want to continue to be leaders in sustainable tourism in the broadest sense of the word in the future.

The average stay increases from 6.97 to 7.16 nights, a 2.69% increase.

To get more out of the data, BRAINTRUST is also investigating howthe average stay has changed. According to the data provided by the consulting firm, it has risen by only 2.69%, from 6.97 nights in 2019, before the pandemic, to 7.16 nights from January to July this year.

Going into even greater detail, BRAINTRUST shows that the largest source market, the United Kingdom, has seen a 5.86% decrease in average length of stay, while Germany has seen a 3.60% increase, France a 2.35% increase, and the United States, already the fourth largest source market in terms of spending, has seen an 8.87% increase.

By destination communities, there are some significant differences, with Catalonia decreasing in average stay by 0.87%, the Balearic Islands falling by up to 3%, Andalusia suffering a decrease of 0.47%, while the Canary Islands experienced a slight increase of 0.09%, the Valencian Community rose by 4.08%, leaving Madrid in the lead with an average stay increasing by 15.79% from 5.10 nights in 2019 to 5.90 nights in 2023.

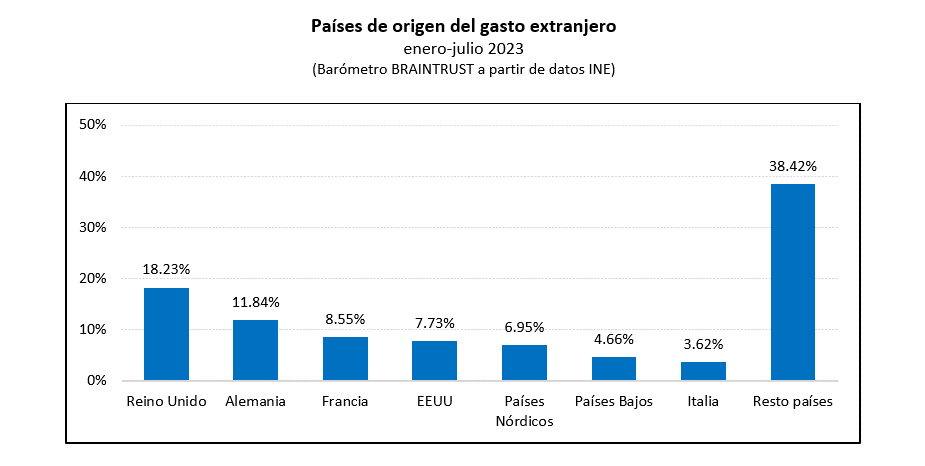

The four major markets—the United Kingdom, Germany, France, and the United States—account for almost 50% of foreign spending.

According to the results of the consulting firm's analysis, the largest markets continue to be the traditional ones, with the United Kingdom leading the way with 18.23% of total foreign spending through July, followed by Germany with an 11.84% share, France with 8.55%, and the United States climbing to fourth place with 7.73% of the total.

Behind them are the Nordic countries with 6.95%, the Netherlands with 4.66%, and Italy with 3.62%.

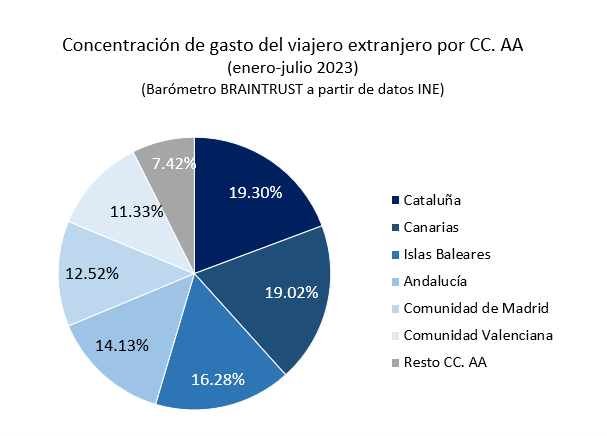

The six main autonomous communities account for 92% of revenue, with a high concentration in mature destinations.

As for the regions that received the most foreign tourists in the first seven months of the year, once again it was the six main autonomous communities that absorbed almost all foreign spending, with 92.58%, demonstrating once again the concentration of this type of tourism in Spain, leaving a negligible 7.42% to the remaining 11 communities.

Thus, Catalonia once again leads the ranking with 11.55 million visitors from January to July, with the Canary Islands close behind with 11.39 million, the Balearic Islands with 9.74 million, Andalusia with 8.46 million, Madrid with 7.49 million, and the Valencian Community with 6.78 million.

They would be followed at a considerable distance by the Basque Country with 1.16 million, Galicia with 1.04 million, and Murcia with 0.62 million.

This fact once again highlights the need to decentralize foreign tourism spending with more effective campaigns in less visited regions.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST:"Once again, our analyses show that we need to analyze the data in detail to understand what is happening in our tourism sector, avoiding facile discourse and highlighting the strengths of our industry, but also the areas for improvement. There is enormous scope for improvement in our sector, which, years after the pandemic, continues to show its strength with another year that is expected to be a record one, but where there are significant gaps, such as the dependence on volume and concentration, in a mass-oriented model in which we seem to remain stuck, unable to break out of the loop. We will see if 2023, beyond the number of tourists, shows that we have acted with a medium- and long-term vision. In fact, the PSTDs (Destination Tourism Sustainability Plans) should address these shortcomings with greater and better positioning of less mature destinations, so the results will have to be analyzed once they are implemented. Once again, the data is not good unless it is analyzed with a business perspective.