BRAINTRUST, a leading consulting and professional services firm in the tourism industry, has released a new industry analysis, this time focusing on the marketing of Spanish travel, thanks to a new wave of its Tourism Barometer. In it, it states that omnichannel marketing is an irrefutable fact in a post-pandemic environment, to which the entire industry must adapt as soon as possible, given that there is no longer a single-channel traveler, and where, through its research, the consulting firm demonstrates the progressive combination of channels, although each product and/or service seems to be the exclusive territory of one or another player in the value chain.

Travel agencies: a place for advice, security, and personalization

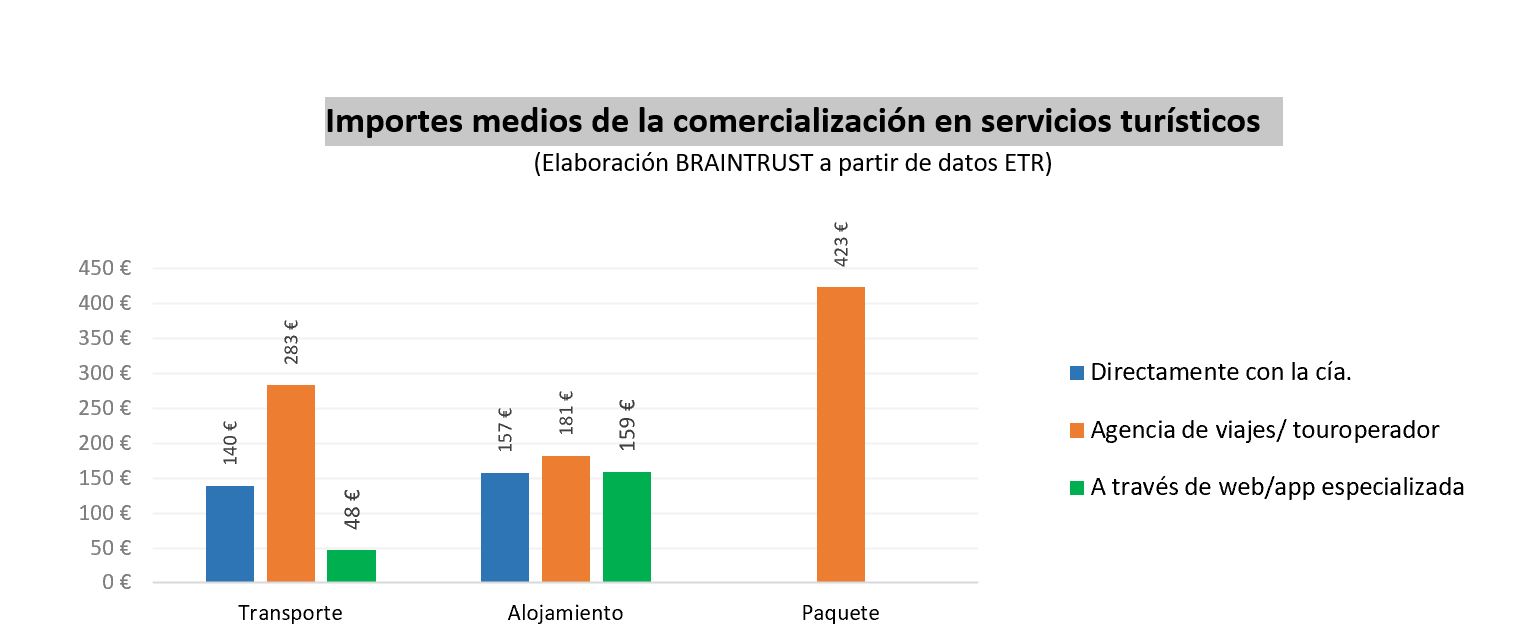

BRAINTRUST continues its analysis of the sector, with the aim of helping the tourism industry to recover and transform itself. In this case, it analyzes the concept of omnichannel marketing in the Spanish travel market, concluding that travel agencies are the channel that would provide users with the most critical advice, security, and personalization for their trips, according to those surveyed in the Barometer. This result is due to the specialization of travel agencies in a more experiential type of travel, both nationally and internationally, where customers place their trust for their most important trips. Following this finding, BRAINTRUST highlights that travel agencies have the highest average spending on transport, accommodation, and package tours due to the type of trips they sell, which are more comprehensive, more diverse, more distant, and certainly richer in unique and exceptional experiences, as opposed to simply purchasing a seat on a means of transport or a room in a hotel or apartment.

According to Angel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST: "As we have been anticipating in our Tourism Barometer for several years now, travel agencies are an essential channel in tourism marketing, given their value to customers, who seek specialization, personalization of the experience thanks to technology, and human contact to prepare for more significant trips. This importance may depend on the purpose of the trip, its complexity, or the unique and distinctive experience that is sought at important moments, such as honeymoons, family trips, group trips, business trips, or experiential trips, to give just a few examples. The pandemic has eliminated some points of sale, which we estimate to be a 20% reduction in travel agency premises compared to 2019, but the market share in this channel remains the same, and could even be higher in view of travelers' behavior patterns after the pandemic, where they are moving away from standard trips to a certain extent to focus on memorable trips, and where only a travel agent can contribute their experience, knowledge, tools, and information to serve a more conscious traveler. Travel agencies are finally learning to highlight their role of specialization, advice, and personalization in response to the changing behavior of travelers, who are increasingly seeking more memorable experiences, within a more humanistic post-pandemic philosophy of life, where being and living take precedence over having and appearing.

The purchase of transportation tickets, an exclusive territory of suppliers

Analyzing the data separately, BRAINTRUST nevertheless proves that the purchase of transport tickets is almost exclusively the domain of providers, with a share that has gone from 81.4% in 2019 across all their platforms (web, app, telephone, and in person) to 81.3% in 2021, demonstrating the relentless power that transport providers wield in tourism marketing when it comes to travel, whether they are airlines, rail companies, land mobility companies, or ferries and shipping companies. In fact, when comparing the two years, the web channel has fallen by 0.6%, while the human contact channel has risen by 0.5%, demonstrating that travelers in these times have placed more trust in people than in pure technology.

Accommodation booking, a space shared directly by hotels and specialized OTAs

The new wave of the BRAINTRUST Barometer also delves into accommodation reservations and purchases, confirming that this is an area shared almost equally by hotels selling directly and OTAs specializing in the sale of rooms and/or tourist apartments.

Direct hotel sales would thus fall from 44.1% in 2019 to 43.7% in 2021, while specialized OTAs would go from 38.2% to 38.5%, leaving brick-and-mortar agencies, owners, and real estate agencies with a small slice of the pie. This highlights that when it comes to accommodation sales, technology is gaining ground, regardless of the channel chosen by the traveler. The strong implementation of easy, fast, and free tools in recent years has sealed the reign of technology in this field, according to BRAINTRUST.

Travel agencies have a monopoly on the sale of tourist packages, both organized and tailor-made.

In the case of travel agencies, they are proving intractable when it comes to marketing the sale of tourist packages, whether these are organized or tailor-made (known as dynamic). Agencies currently sell 85% of packages, up from 83.4% in 2019, once again demonstrating their strong position in the purchase of complete trips and pointing to even greater growth in the coming years given the complexity of traveling in times of uncertainty, to which we are already becoming accustomed. BRAINTRUST also takes a close look at its studies, highlighting that within travel agencies, the web channel has grown from 28.9% in 2019 to 39.4% in 2021, while the personal channel has gone from 54.5% just before the pandemic to 45.6% last year, reflecting the technological advances brought about by the pandemic, which travel agencies have been able to explore and exploit effectively, offering their customers all available channels (store, website, app, email, social media, forums, blogs, etc.), something that was unthinkable just a few years ago, when face-to-face sales of packages were the norm.

Forecasted changes in channels by product in 2022

Looking ahead to 2022, the consulting firm predicts the following changes:

- Maintaining the share of suppliers in transportation, in light of the customer relationship strategies being pursued by major suppliers, such as airlines, railways, ground transportation companies, and shipping companies.

- Increase in direct hotel sales by 2 percentage points, due to the widespread implementation of revenue management programs by hotel companies, to the detriment of contracts with intermediaries.

- 3 p.p. increase in the share of agencies in package tours, given the expected rise in prices, the supply crisis, the need for security, and the "uncorking" effect of the recovery of vacation travel among Spanish consumers.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST: "Omnichannel retailing is an irreversible fact, and in this sense, all links in the value chain must move forward, continuously analyzing not only the market share but also the profitability of each channel, in order to achieve a more balanced business model. At BRAINTRUST, we have been helping all players to optimize their channels through our methodologies for maximizing them, optimizing pricing strategies, or segmenting customers by niche based on attitudinal rather than sociodemographic variables, and we insist on translating data into business decisions. The channel has become not only a means of marketing, but also a tool with greater or lesser profitability depending on the balance of the channels in the distribution. The tourism industry faces three challenges that must be addressed in a highly professional manner and with the help of experts: profitability, innovation, and sustainability in all its meanings.