The consulting and professional services firm BRAINTRUST, a leader in the tourism sector, has released a new report from its Tourism Barometer analyzing the use of booking channels by Spaniards, observing how trends in the Spanish outbound market are evolving, which appears to be regaining its usual momentum after the post-pandemic period.

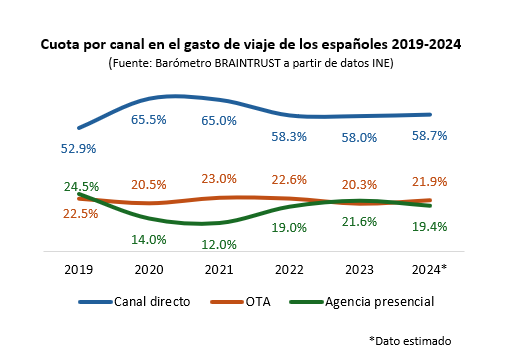

Brick-and-mortar agencies account for 19.4% of spending, OTAs for 21.9%, and direct sales for 58.7%.

Focusing on spending by channel, data from the new BRAINTRUST Barometer confirms that direct sales would be taking slightly more than half of the pie, despite the fact that traditional and digital channels have regained ground after the pandemic. Specifically, direct sales will reach 58.7% in 2024 (down from 65.5% in 2020), while traditional and digital channels will account for around 19.4% and 21.9%, respectively.

Physical agencies, meanwhile, would increase their share of Spanish outbound spending, rising from 14% in 2020 to 19.4% in 2024. Finally, OTAs would rise from 20.5% in 2020 to 21.9% in 2024, but would fall from 23% in 2021.

Physical agencies dominate package tours, accounting for 66.7% of total spending by Spanish travelers.

It is confirmed that package sales remain the domain of traditional agencies, where they continue to be unbeatable, accounting for two-thirds of total Spanish traveler spending, specifically 66.7%. OTAs, for their part, account for one-third, reaching 33.3% of total spending in the Spanish outbound market.

In terms of average price, physical agencies have achieved an average ticket price of €743 this year, which is much higher than the €534 achieved by OTAs. This confirms the fact that higher-value trips, which require expert and specialized advice, are sold in travel agency stores, while lower-value trips, which are also less complicated, are sold on websites.

Transportation expenditure would be distributed as follows: 80.5% of expenditure for direct sales by the final supplier, 9.8% for OTAs, and 9.7% for traditional agencies. In the case of accommodation, 67.6% of expenditure would be for direct sales, 25.7% for OTAs, and 6.7% for the physical channel.

According to Ángel García Butragueño, Director of Tourism at BRAINTRUST: "Our Tourism Barometer continues to measure business indicators for the travel agency sector. After a post-pandemic period, in which travel has become a vital attitude compared to its previous status, intermediation continues to rise in the share of spending by Spanish travelers, who see critical added value in its value proposition. Thus, brick-and-mortar agencies, even with fewer points of sale, are recovering a good part of the spending, due to their specialization in long-distance travel, greater complexity, and better experience with a special emphasis on value-added tourist packages, while OTAs are taking a large share of the dynamic package market. Direct sales, however, are losing ground compared to 2020, but dominate the area of individual services, predominantly in transportation. The future definitely lies in omnichannel retailing.

Older generations remain loyal to travel agencies, while young people don't even set foot in them.

BRAINTRUST data confirms yet another year of aging among users of brick-and-mortar travel agencies, with 22.8% of people over 65 using them, while the younger generations account for less than 5%.

In fact, while 6.2% of users under the age of 25 use them (largely motivated by study trips), users aged 26 to 35 only use them 3.3% of the time, those aged 36 to 45 use them 5.9% of the time, travelers aged 46 to 55 use them 7.6% of the time, and those aged 56 to 65 use them 10.3% of the time.

The consulting firm is once again alerting agencies and recommending that they define strategies for new travelers, given that current portfolios will eventually be depleted, posing a serious problem for future traffic and undermining their business model, which will eventually disappear if nothing is done about it.

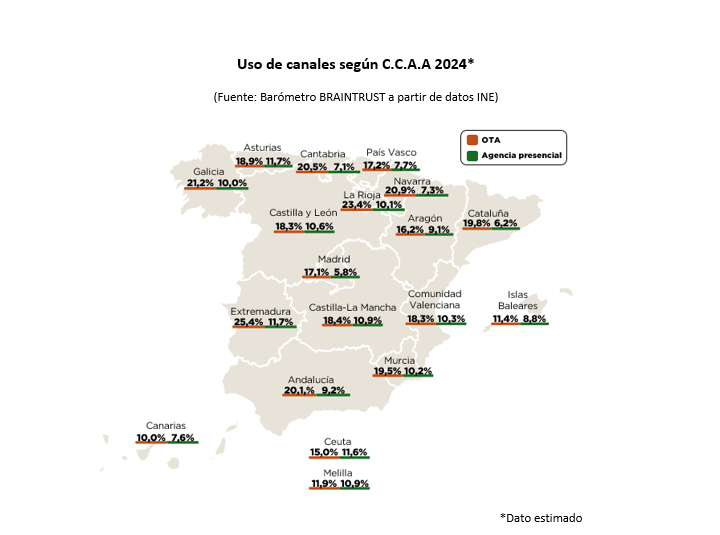

The most densely populated areas use digital channels, while those with fewer inhabitants use face-to-face channels more.

Analyzing the data in greater depth, it is very relevant to see the share of physical and digital channels by passenger-sending region as outlined by BRAINTRUST.

In this regard, regions with larger populations are less prevalent in the face-to-face channel, reaching a penetration rate close to or even below 6% in autonomous communities such as Madrid and Catalonia, with 5.8% and 6.2% respectively. However, in order to resize the networks appropriately, it is very important to look at other areas where penetration is much higher, such as Ceuta and Melilla, Asturias, Extremadura, Castile and Leon, Castile-La Mancha, and the Valencian Community.

To this end, BRAINTRUST designs a channel penetration map, which should be on the desks of all agency executives in Spain, so that they have a clear and objective view of where networks should be today and how they evolve over time.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST: "It is vitally important to observe how Spanish travelers use different channels. We are seeing important trends such as the continued rise of the digital channel, albeit with increasingly limited reach, while brick-and-mortar agencies are regaining ground, but with a major challenge: regenerating their portfolios, as it is the older generations who remain loyal, while younger travelers, especially millennials, Gen Zers, and those who came after them, hardly use them at all due to their digital knowledge and skills. At BRAINTRUST, we continue to believe in the value of intermediation in a new era where unique and memorable moments are sought after, which are more difficult for travelers to achieve on their own. With the help of an expert advisor from a travel agency, whether physical or digital, travelers have access to more and better information, but above all, they receive customer-oriented guidance, which is essential when designing experiences. An objective, rigorous, and continuous analysis of data, such as that carried out through our BRAINTRUST Barometer, allows us to anticipate trends and helps tourism companies maximize their strategies and plans for the future.