The consulting and professional services firm BRAINTRUST, a leader in the tourism sector, has released a new report from its Tourism Barometer that analyzes Spanish household spending, reaching important conclusions and affirming that Spaniards prioritize the philosophy of enjoying life over material possessions, especially given the effects of the pandemic on lifestyle behaviors.

Thus, in all income brackets analyzed, spending on restaurants, hotels, leisure, and culture exceeds spending on traditionally important areas such as fashion, technology, education, and even healthcare (which has a greater public presence in Spain).

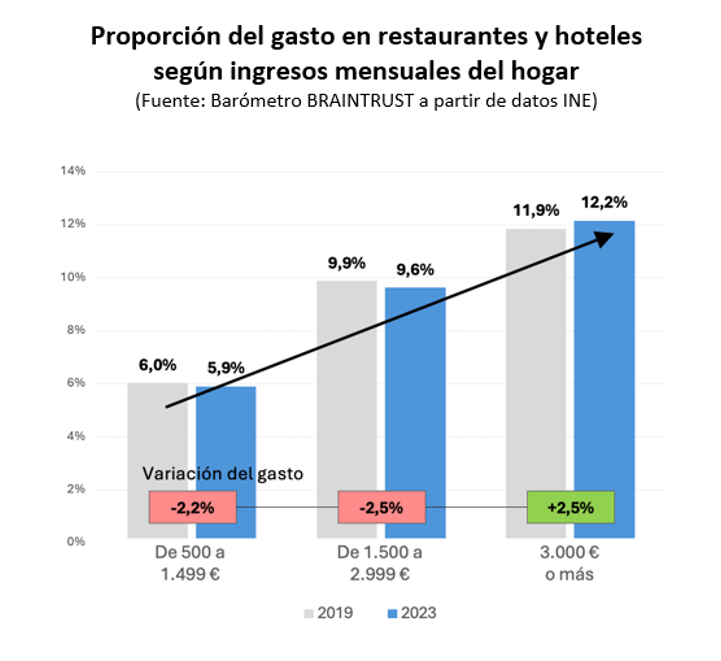

Spending on hotels and restaurants rises among wealthier families and falls among poorer families.

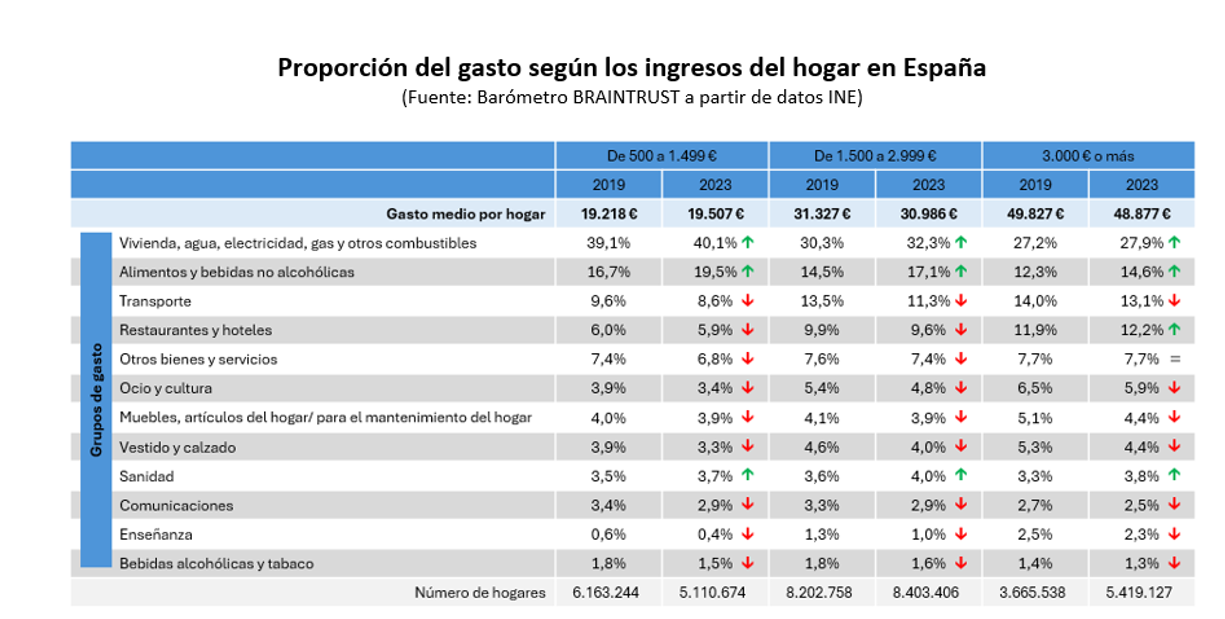

According to data from BRAINTRUST, households in Spain show significant differences in the weight each assigns to each category of expenditure.

Thus, in the most privileged households, spending on restaurants and hotels accounts for 12.2% of the total, an increase compared to 2019, when it accounted for 11.9%.

In contrast, in lower-income households, this same category only accounts for 5.9%, even decreasing compared to 2019, when it represented a slightly higher share of 6%.

If we add the section on leisure and culture to that on hotels and restaurants, the weighting in the first group would increase to 18.1%, and in the second group to 9.3%, confirming that Spaniards are spending more on these aspects after the pandemic, second only to housing and food.

The rest of households would fall into the middle range, with 9.6% in this category, down from 9.9% in 2019, which, combined with culture and leisure, would reach 14.4%.

According to Ángel García Butragueño, Director of Tourism at BRAINTRUST: "The data in our possession reflects a very particular way of life among Spaniards, in line with the behavioral changes that have occurred since the pandemic. However, these habits are often curtailed by extrinsic factors such as household budget availability. In recent times, faced with rampant price increases, households have had to watch where they spend every euro and adjust their spending to the needs of their families. Higher-income households continue to drive consumption in the restaurant and hotel sector, as well as in leisure and culture, and, as a side effect, in tourism, but there is a noticeable slowdown in other families, confirming that the euphoria unleashed in tourism has more to do with foreign tourism, where we continue to rely on borrowed tourists, than with Spanish tourism. We advise our clients to redefine their distribution strategies in order to optimize opportunities. A strategy that is valid for one year may not be valid for another.

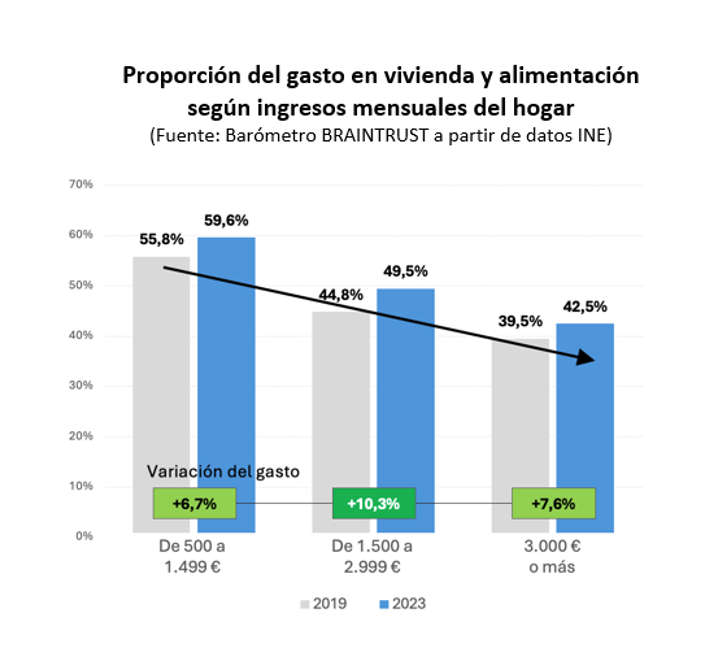

The weight of spending on housing and food increases compared to 2019

Meanwhile, in higher-income households, the share of the budget allocated to housing and food is lower, at 42.5%, up from 39.5% in 2019.

Analyzing the middle-income household bracket, housing and food account for 49.5% of total household expenditure, an increase of 4.7 points since 2019. In contrast, lower-income households spend a total of 59.6% on housing and food, leaving only 5.9% available for hotels and restaurants, confirming a slowdown in spending as the two most necessary items skyrocket, thereby weighing down the category dedicated to entertainment and leisure.

Spending on what BRAINTRUST calls entertainment and recreation, which includes restaurants, hotels, leisure, and culture, therefore ranks only behind housing and food, whose weight in household spending has skyrocketed since 2019 due to the effect of inflation.

According to José Manuel Brell, Partner in charge of Quantitative Studies and Models, and the Tourism and Leisure Industry at BRAINTRUST: "It is always a good idea to analyze Spanish consumption data, which changes depending on the socioeconomic scenario and provides very accurate forecasts that must be taken into account when designing companies' short-, medium-, and long-term strategies. In the case of spending on leisure, restaurants, culture, and hotels, it is clear that Spaniards want to make this a priority, but the impact of housing prices (both rent and purchase) and food prices is reshuffling spending categories, with significant differences depending on household income brackets in Spain. As we always believe at BRAINTRUST, putting data at the service of business is increasingly important in order to consider future market scenarios and thereby determine the right products for each group.