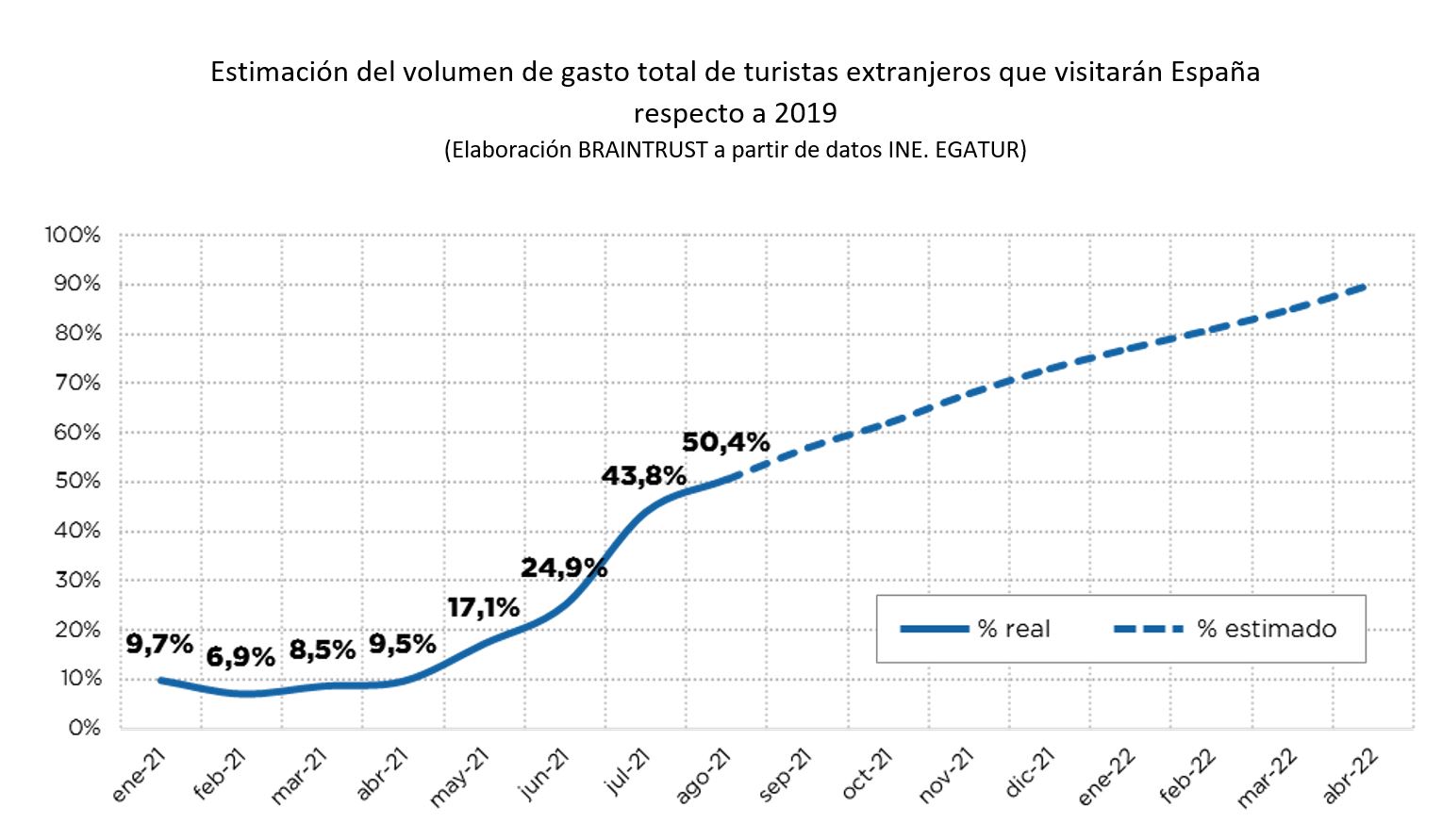

BRAINTRUST predicts in a new study on foreign tourism spending that by Easter 2022, figures will be close to those of 2019, based on the current pace of recovery in international markets. In a new wave of its Tourism Barometer, it points to an exponential increase in international travelers in the coming months, between now and April next year, when figures similar to those seen before the pandemic could be reached.

Inbound vacation tourism is recovering month by month.

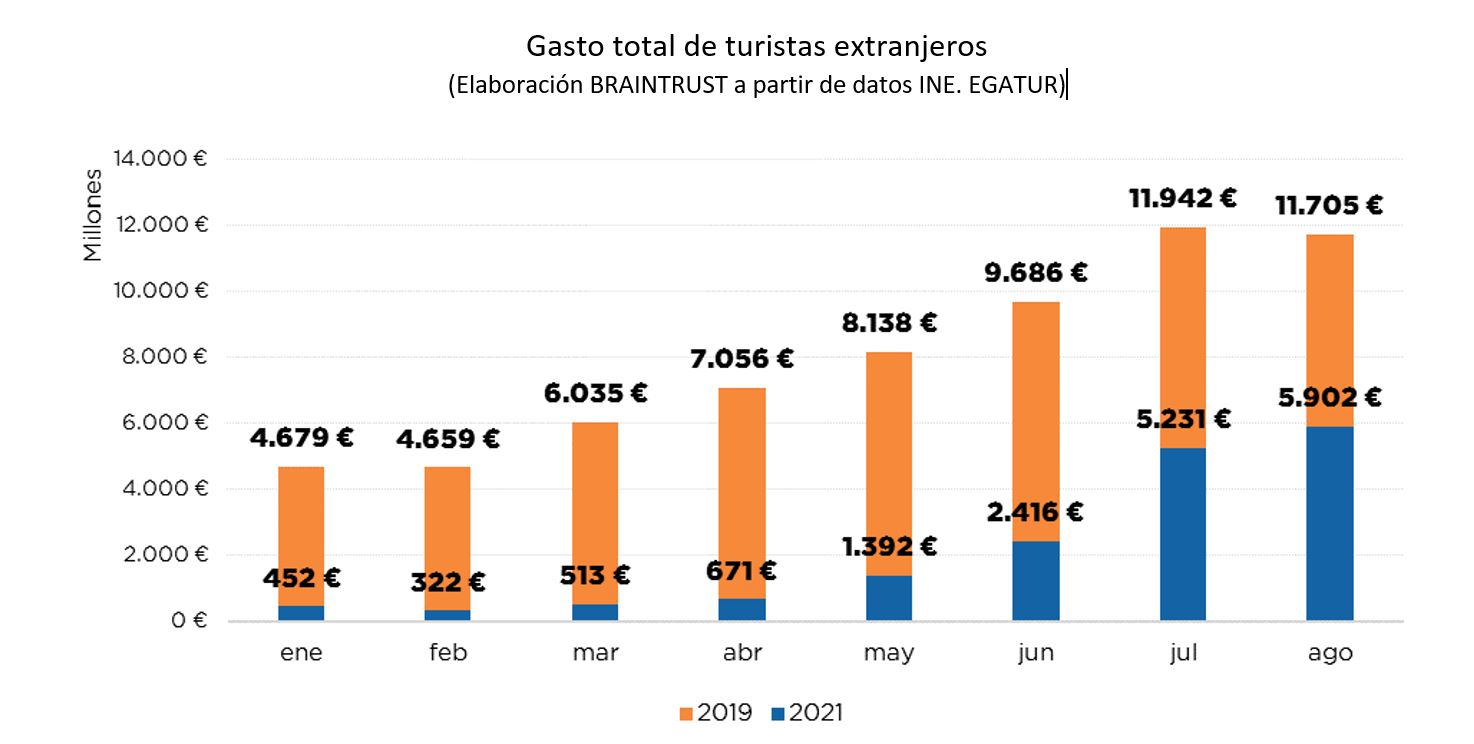

Spending by foreign tourists is recovering, and although we are still some way off the figures for 2019, the gap is narrowing month by month. while in January total spending by international tourists fell by 90.3% compared to the same month in 2019, in August this variation was 49.6%, reaching €5.9 million, so the trend is positive, as can be seen in the following graph:

Analyzing the trend in total spending in recent months, and if there are no new waves and borders remain mostly open as they have been until now, it could be estimated that during Holy Week 2022, the volume of foreign tourists visiting Spain would be practically the same as in 2019, with a recovery of around 90% of international spending, which would bring us back to practically pre-pandemic volumes.

For Angel García Butragueño, Co-Director of the Tourism Barometer and Director of Tourism at BRAINTRUST, "The current status of the vaccination program in Europe has allowed us to gradually recover foreign tourists this summer. Without new waves and with exhaustive control of the risk of contagion, Spain could recover a large part of foreign tourism spending by Easter 2022. The coming months will be key to confirming a Europe without restrictions and an increase in movement, which would facilitate a return to pre-pandemic figures in the inbound holiday segment, giving the industry a breather as it prepares for a definitive transformation towards a new post-COVID era. The forecasts provided by the BRAINTRUST Barometer should not be a barrier to seizing the opportunity and preparing for a different, more sustainable, more innovative, and more profitable form of tourism that will help us remain world leaders. The real challenge lies in achieving pre-pandemic figures while destinations prepare to undertake the transformations pursued by the Next Generation European funds, through the Plan for Modernization and Competitiveness in Tourism of the Secretary of State for Tourism.

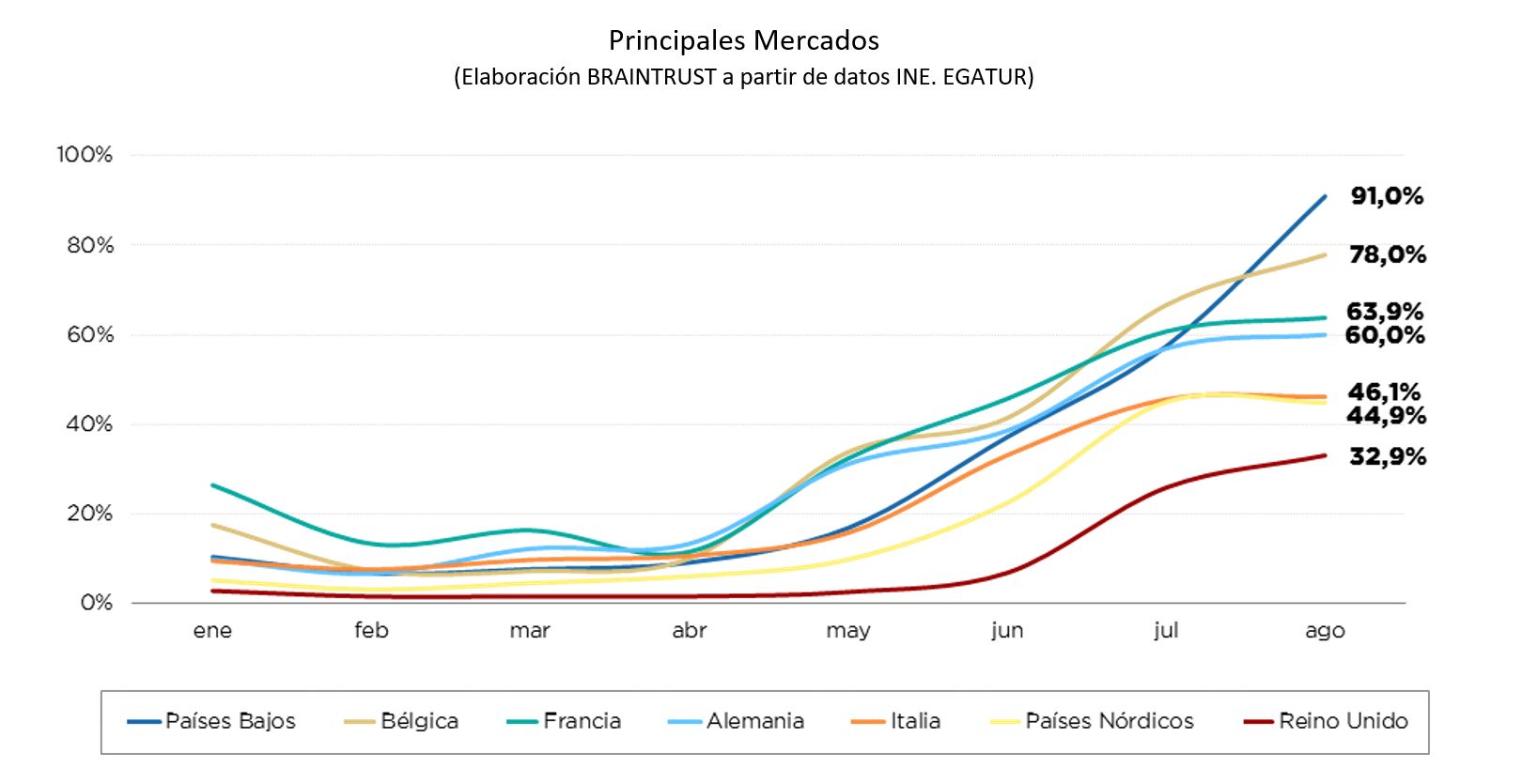

Four key countries in the recovery

The markets that are performing best, and therefore contributing most to this positive trend, are the Netherlands, Belgium, France, and Germany, while the United Kingdom is the one that is hurting us the most.

The Netherlands has fared significantly better than the rest, with only 9% fewer visitors in August than in August 2019. Belgium has also responded well during the summer months, reaching 78% of visitors, while France and Germany have remained at around 60%.

The opposite is true for the United Kingdom. Spain's biggest source of international tourism was hampered by travel restrictions and quarantines imposed by the UK government, meaning that in the first five months of the year, only 2% of the British tourists who visited Spain in the same months of 2019 arrived, and in August they lagged behind with only 32.9%.

Percentage of foreign tourists who have visited Spain in the last 8 months compared to 2019, by country of origin

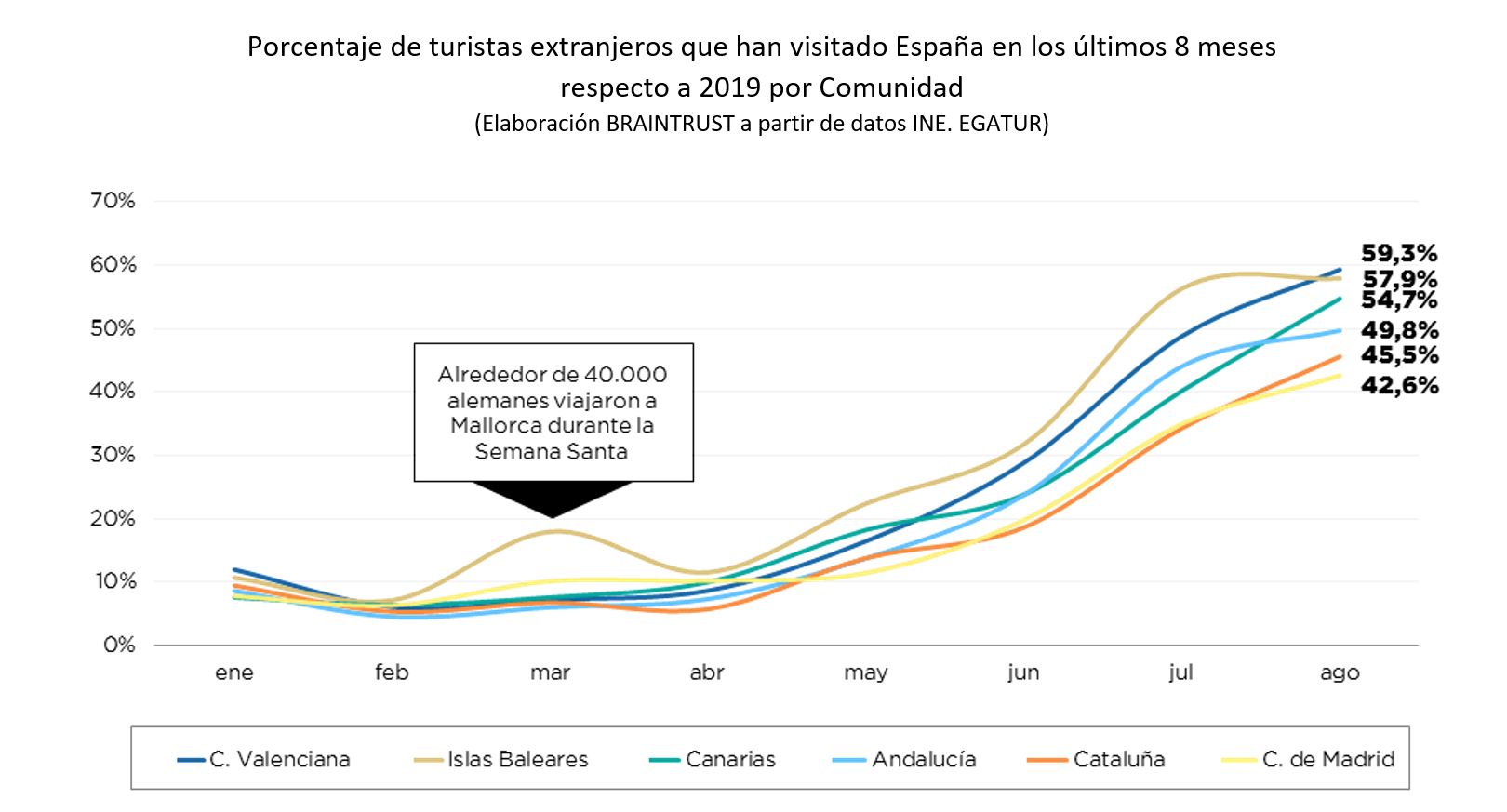

Trends in the most sought-after autonomous communities

The six most visited autonomous communities in Spain have performed similarly in terms of foreign tourist arrivals so far this year compared to 2019, but with certain nuances:

- Virtually all regions began the year with only 10% of the tourists they received in 2019.

- The Balearic Islands experienced an upturn in March, just as Germany removed the islands from its "blacklist," and thousands of Germans decided to spend Holy Week here.

- Starting in April, although all regions are progressing in parallel, the gap is widening, with sunny beach areas attracting more tourists.

- In August, the Valencian Community, the Balearic Islands, and the Canary Islands recovered between 55% and 60% of their tourists, while Catalonia and the Community of Madrid lagged somewhat behind.

For José Manuel Brell, Co-Director of the Tourism Barometer and Partner responsible for Quantitative Studies and Models at BRAINTRUST:"This summer's figures allow us to be optimistic about the future, with the seven major markets on the road to recovery—although the United Kingdom has been slower, the lifting of the red alert has been a great relief in recent weeks—and with the six largest autonomous communities showing positive trends in their foreign tourist numbers and consequent spending. Despite the policies promoted by some destinations seeking higher-spending tourists, the industry must first recover the closest markets, so as to facilitate the return to employment of families working in this sector, while we make the transition to the Spanish tourism model. In this regard, collaboration between public bodies and private companies is essential if we are to remain at the top of the global podium as we transition to a new post-pandemic era.