Continuing with its analysis of the impact of COVID-19 on the sector, BRAINTRUST has conducted a new wave of its Tourism Barometer survey, which reveals what types of accommodation will be most sought after once tourism picks up again in Spain, based on both the traveler profile and the type of tourism that will most help to recover demand for vacations in 2020.

The accommodations chosen by young people, the least affected

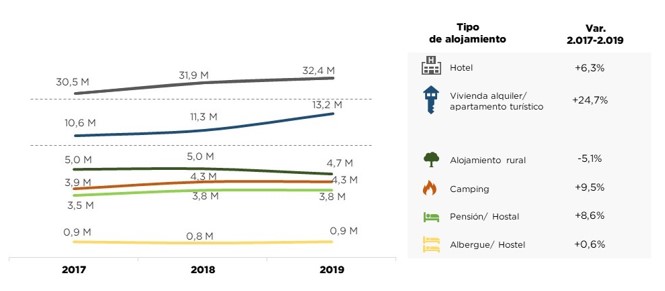

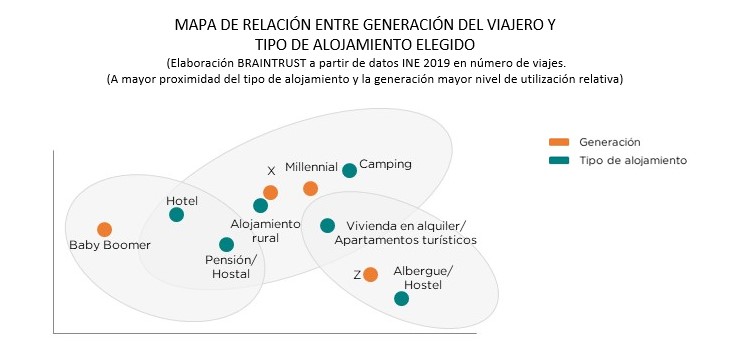

Given that young people will be the first to resume their travel plans and getaways, as indicated in the previous analysis carried out by BRAINTRUST, hotels, guesthouses, and hostels will be the types of accommodation most affected by the COVID-19 crisis, as they are the most popular choices for older travelers, who will be the slowest to resume tourist activities. On the other hand, the biggest beneficiaries will be campsites (with growth of 9.5% in the last three years), hostels (+0.6%) and tourist apartments (+24.7%), which are more in demand among young people.

In a more detailed analysis by generation, we see that older people, Baby Boomers (over 56), mainly choose hotels (25.4%) and guesthouses and hostels (20.4%) for their getaways and vacations. At the other end of the spectrum, we find the youngest, Generation Z (under 25), who particularly prefer hostels (41.2% of those who stayed in hostels are from this generation), followed by rental accommodation (14.4%).

On the other hand, we see more similar behavior among those belonging to Generation X (between 40 and 55 years old) and Millennials (between 26 and 39 years old), although there are some differences. While Generation X primarily chooses rural accommodations (47.5%) and campsites (45.6%), Millennials also demand campsites (37.6%) and tourist apartments (32.0%).

Analyzing the gender of travelers, we also find different preferences for where to stay. Men are more likely to choose hotels (54.3%), guesthouses and hostels (59.0%), and hostels (54.4%). Women, on the other hand, are more likely to choose tourist apartments (52.7%) and campsites (58.0%) for their vacations. The least difference is found in rural accommodation, with similar behavior between both genders, although with a slight preference among women (50.3%).

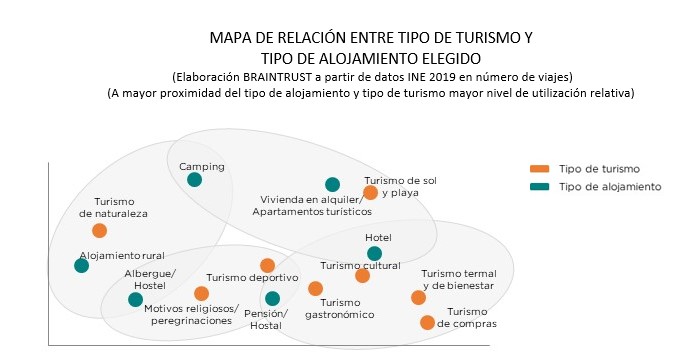

Another conclusion reached by BRAINTRUST reaches in its latest Tourism Barometer is that there are also differences in behavior when choosing where to stay, depending on the type of trip in question.

For tourists who decide to travel to nature destinations, the most popular types of accommodation are rural (62.9%), campsites (45.6%), and hostels (36.6%). When beach getaways are chosen, campsites (42.5%), hotels (38.9%), but above all apartments and rental homes (58.1%) are also chosen. For those who decide to take cultural getaways, the preferred types of accommodation are guesthouses and hostels (38.4%) and hotels (33.4%). For both sports tourism and religious tourism, hostels (32.6% and 8.6%) and guesthouses and hostels (14.5% and 3.6%) are chosen. While guesthouses and hostels are in demand for gastronomic destinations (5.6%), hotels are preferred for spa and wellness tourism (4.6%), and both guesthouses (1.6%) and hotels (0.9%) are chosen for shopping tourism.

This relationship also tells us which types of accommodation will be less affected than others more closely linked to destinations that will be less in demand due to the COVID-19 crisis. Trips to natural environments will be among the first to rebound this summer, as they offer the possibility of spending a vacation away from crowds. Once again, campsites, hostels, and rural accommodations will be among the establishments that will recover first after the health crisis.

On the other hand, we find destinations that could initially generate a lower sense of social and health security, and which will be the last to recover. We are referring, for example, to sun and beach tourism, as well as shopping tourism, which are also closely related to hotels.

Differentiation, key to overcoming the impact of COVID-19 on accommodation

The accommodations most affected by COVID-19 will undoubtedly have to adapt to the new times and protocols, modifying their offerings in line with new trends in order to regain the confidence of tourists.

According to Ángel García Butragueño, co-director of the BRAINTRUST Tourism Barometer and head of Tourism and Leisure: "Never before has the sector faced such a challenge and such a great opportunity for transformation. It will be necessary to reinvent itself, but always with the consumer's wishes and the medium/long term in mind. There is no doubt that this pandemic will pass, but the transformation of the sector must remain."

One of these new trends is related to the type of establishment chosen for vacation accommodation. Eco-friendly accommodations have gained the most followers in recent years (36.6%). In fact, around 69% of travelers would be willing to pay more for a sustainable stay. Themed accommodations are also becoming increasingly attractive to travelers (30.5%), with younger generations showing the greatest interest in both cases.

On the other hand, the digital world and social media have become great allies for companies looking to advertise effectively. In this regard, 72% of travelers say they take into account online reviews of accommodations, activities, and restaurants when choosing them for their trips and getaways. And there is a minimum score below which the establishment is not considered.

It is essential to know what tourist accommodations can offer travelers in order to better adapt to their needs and help them stand out from the rest. The Braintrust Tourism Barometer reveals that the aspects that generate the most interest among guests are those related to advice and personalization, even above technology (connected rooms, booking services via apps, customer service via WhatsApp, etc.). We are referring to advice on local sites and activities, as well as gastronomy related to local and organic products; in short, offering valuable elements that allow travelers to integrate and immerse themselves in the culture and customs of the place they are visiting. Agreements with restaurants, shows, etc. that offer some kind of discount to travelers and having specific leisure areas within their facilities are other aspects that are well received by tourists.

For José Manuel Brell, co-director of the BRAINTRUST Tourism Barometer and partner responsible for studies and quantitative models: "Despite what it may seem, no type of establishment can claim victory and none can feel defeated. A correct value proposition, aimed at the right target (in terms of channel and form), can succeed in conveying the necessary confidence to travelers and recover pre-crisis levels sooner than might be expected. And it seems that personalization and integration into local culture and customs may be key."