-

Spain is the ideal setting for the growth of this type of entity.

-

More than 1 in 10 Spaniards are already customers of a neobank.

-

The typical customer is under 50 years old, familiar with new technologies, and tends to compare before purchasing a product or service.

-

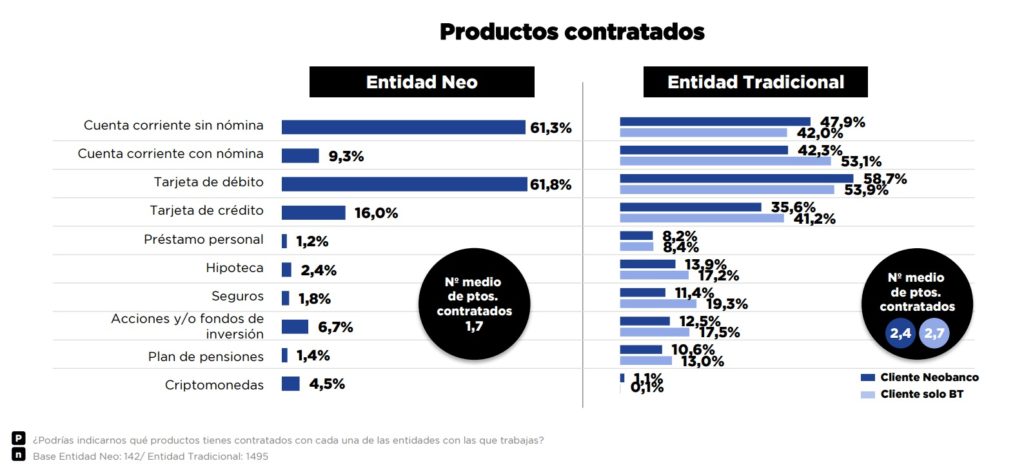

The main products that customers of a neobank sign up for are low-commitment, primarily accounts without payroll and debit cards.

-

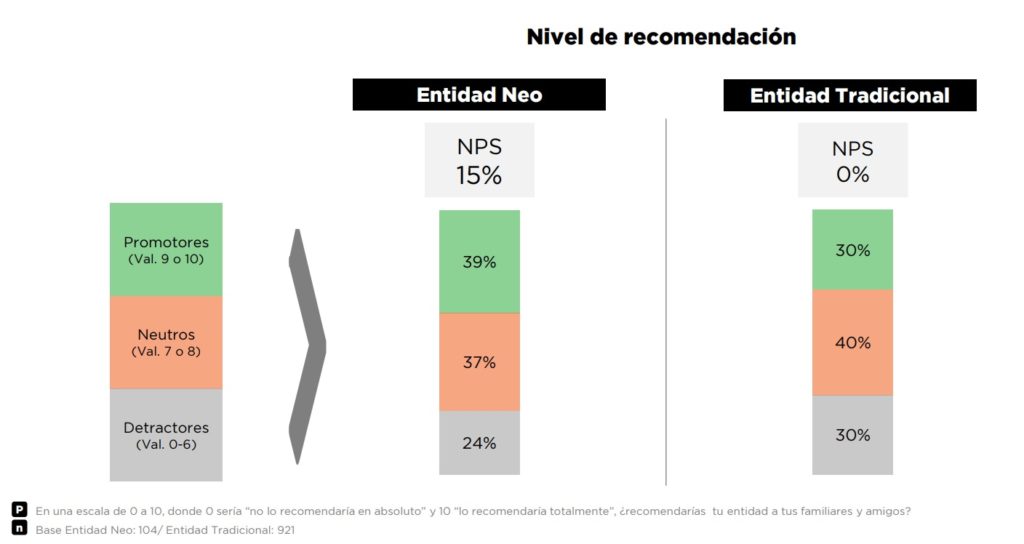

Recommendations from neobank customers exceed those from traditional banks

According to the first Digital Banking Observatory conducted by BRAINTRUST, Spain is an ideal setting for the growth of neobanks, with 98.3% of the population over the age of 15 having access to banking services.

In 2021, 95.9% of households had broadband access and 91.8% of people used the internet regularly. Among the most common activities, in seventh place, was the use of online banking, with 65.2%, and the total number of active bank accounts in digital banks was close to 9 million at the end of 2020.

This playing field invites neobanks to strengthen and improve their offerings in our country, and more and more institutions are positioning themselves in Spain to attract customers in a segment where, despite rapid growth, the opportunity is still very large.

One in ten Spaniards is a customer of a neobank.

It should be noted that neobanks are exclusively digital financial institutions, while digital banking is an extension of traditional banks that have adapted their services to the online environment. Neobanks are usually independent companies that operate without physical branches, while digital banking is offered by established banks that have both a physical presence and online channels.

Neobank customers now account for 11.3% of the total banking population, or, in other words, more than 1 in 10 Spaniards is a neobank customer. Seventy-five percent of these customers are mixed customers, meaning they are customers of a neobank and also of another so-called traditional institution. The other 25% only have an account with a neobank.

In terms of regions, Central Spain and Eastern Spain stand out as having the highest penetration of this type of institution, while Northern Spain and Catalonia show somewhat more resistance to becoming customers of these 100% digital banks.

Profile of a neobank customer: under 50 years old, tech-savvy, with higher education and upper-middle income.

According to the digital banking observatory created by BRAINTRUST, 80% of neobank customers are under 50 years old. Above that age, the penetration of this type of institution declines among the population.

Compared to customers of other types of institutions, neobank customers have a clear preference for online transactions, consider themselves very tech-savvy, and take other users' comments into account before making purchasing decisions. Being very familiar with technology, they report shopping online, paying with their cell phones, using Bizum, and sharing content on social media more frequently than customers of traditional banks.

In this regard, they are considered thoughtful individuals when purchasing or contracting a product or service, comparing options and taking the time to choose the one that best suits their interests.

According to Jose Manuel Brell, Director of the Observatory and Head of Banking and Financial Services at BRAINTRUST: "Given the prototype customer that these types of entities currently present, neobanks face a double challenge: On the one hand, in the short term, they must be able to reach new market niches where they are currently having little success (mainly middle-aged people with some technological habits), ensuring that they no longer perceive neobanks as institutions only for "modern," "technological," or young people. On the other hand, the tremendous opportunity represented in the medium to long term by customers who will increasingly fit this technological profile regardless of their age, in a context in which competition between digital institutions (whether "pure" or not) will become increasingly fierce.

Neobank customers start small: basic products with few ties

Another noteworthy fact highlighted by the Digital Banking Observatory report produced by BRAINTRUST is the signing up for basic products (mainly accounts without a payroll and debit cards, always without fees) as customers' first point of contact with neobanks.

According to the Observatory, the average number of products contracted by neobank customers is 1.7, compared to 2.7 for customers of traditional banks. While it is true that the range of products offered by neobanks is much smaller and less complex than that of other institutions, it is noteworthy that only 9.3% of neobank customers have their payroll at that institution and only 16% apply for a credit card.

New entrants have been working for some time to reverse this trend, expanding their product portfolios and offering increasingly attractive deals and welcome promotions to customers who commit to them in some way (by bringing their payroll or maintaining a minimum average balance, for example), while some institutions are gaining notoriety in order to overcome that first barrier of possible ignorance or fear of being the first to try something new on the part of the customer.

An analysis of the usage patterns of other financial products shows that neobank customers are the ones who have the most products on other financial services platforms beyond banks, more specifically on cryptocurrency and money transfer and currency exchange platforms. On the other hand, mortgages and home and life insurance are the products most commonly taken out with banks, due to the sense of security they provide and the absence of these types of products at many of the new 100% digital institutions.

It is worth noting the percentage of neobank customers who do not have any type of insurance, possibly related to the young profile of customers of this type of institution.

Recommendations from neobank customers exceed those from traditional banks

Neobanks have a higher recommendation rating than traditional banks. Among neobanks as a whole, 39% of customers rate their bank's recommendation with a 9 or 10, while 24% give it a rating below 6, suggesting an NPS (Net Promoter Score) of +15.

In the case of traditional entities, promoters and detractors are on the same level, resulting in an NPS of 0.

For more digitally savvy customers, it is mainly fees, but also ease and convenience, and the ability to carry out transactions from abroad that most influence them to recommend their banks to family and friends. More traditional banking customers recommend their banks for the quality of service and professionalism, and the trust and security they place in the institution.

Being able to count on personal attention at the bank is especially important for customers who exclusively use traditional banks, particularly when it comes to opening an account, taking out a mortgage, or receiving any kind of advice. Neobank customers consider customer service via telephone, WhatsApp, or online to be sufficient.

However, across all types of customers, face-to-face service is highly valued when taking out loans, mortgages, or investment products.

Photo by Rodion Kutsaiev on Unsplash